Online Steps to Pay TDS on Sale of Property

- STEP 1 – Login to Income Tax Portal with Buyer’s PAN – https://eportal.incometax.gov.in/iec/foservices/#/login

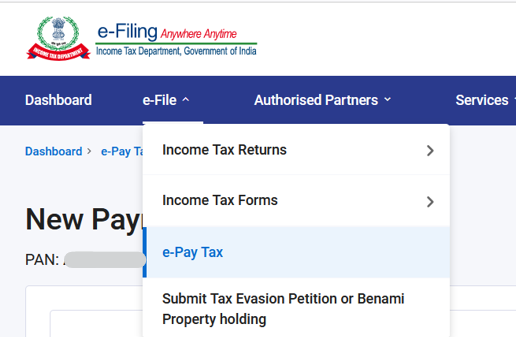

- STEP 2 – Take mouse on “e-File” and click on “e-Pay Tax” from drop down menu

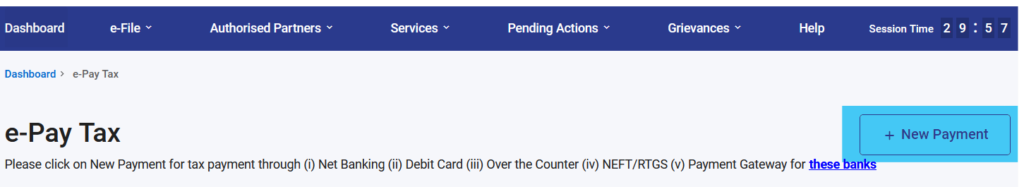

- STEP 3 – Click on “New Payment” on Right Hand Side of the screen

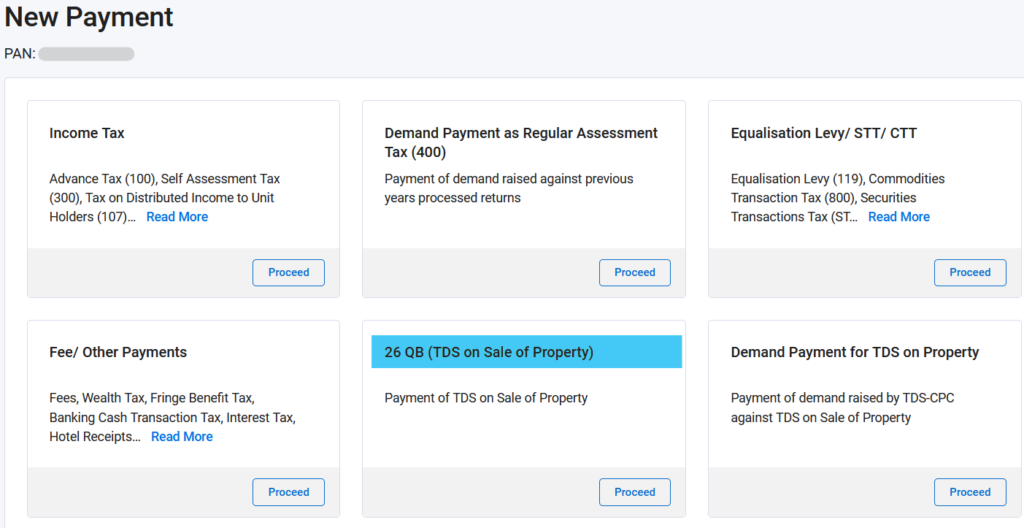

- STEP 4 – Click on “Proceed” of section “26 QB ( TDS on Sale of Payment )“

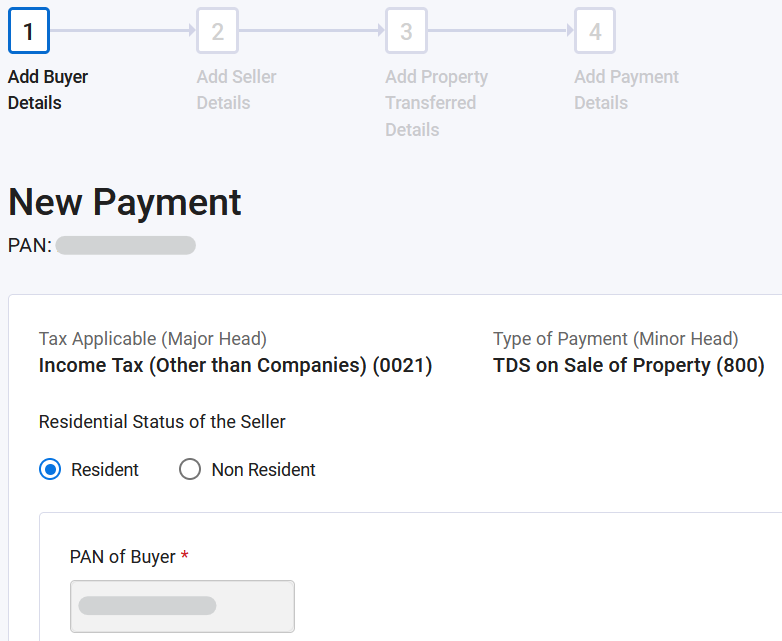

- STEP 5 – Details of Buyer, PAN holder, is Pre-Populated, fields are NOT editable

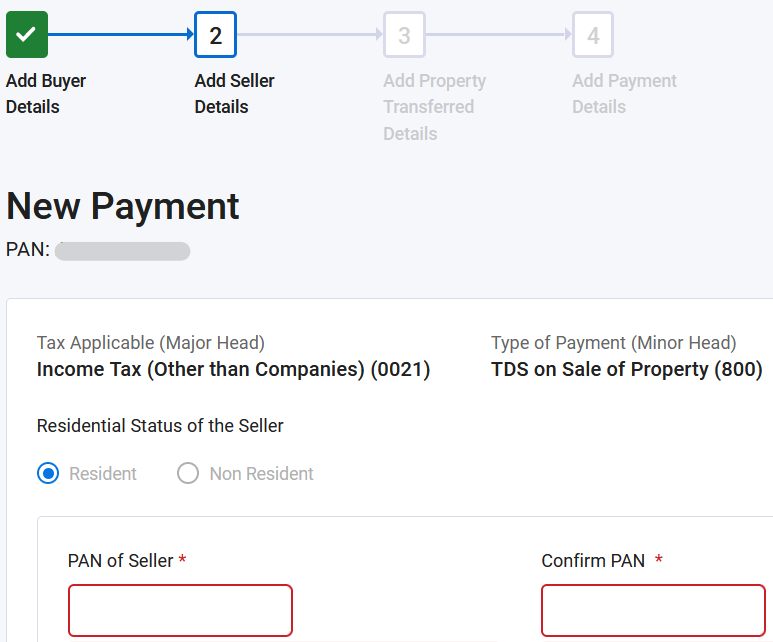

- STEP 6 – Enter details of Seller

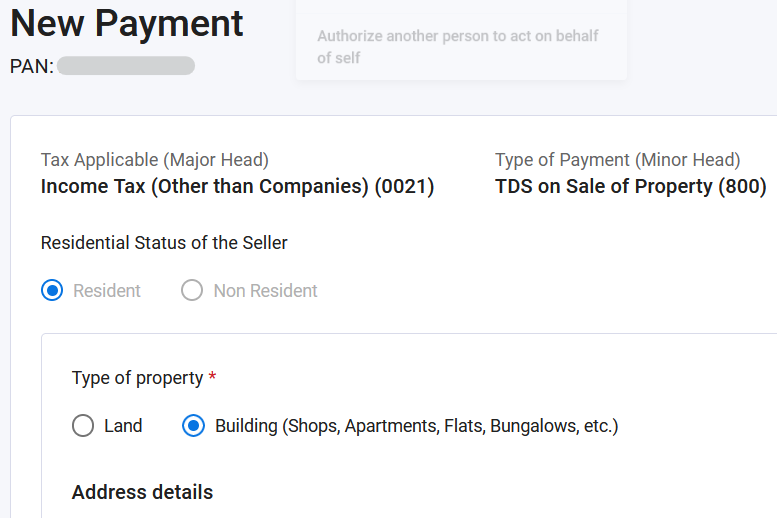

- STEP 7 – Enter details of Sold Property, Property and Stamp Duty Amounts. TDS is calculated at 1%

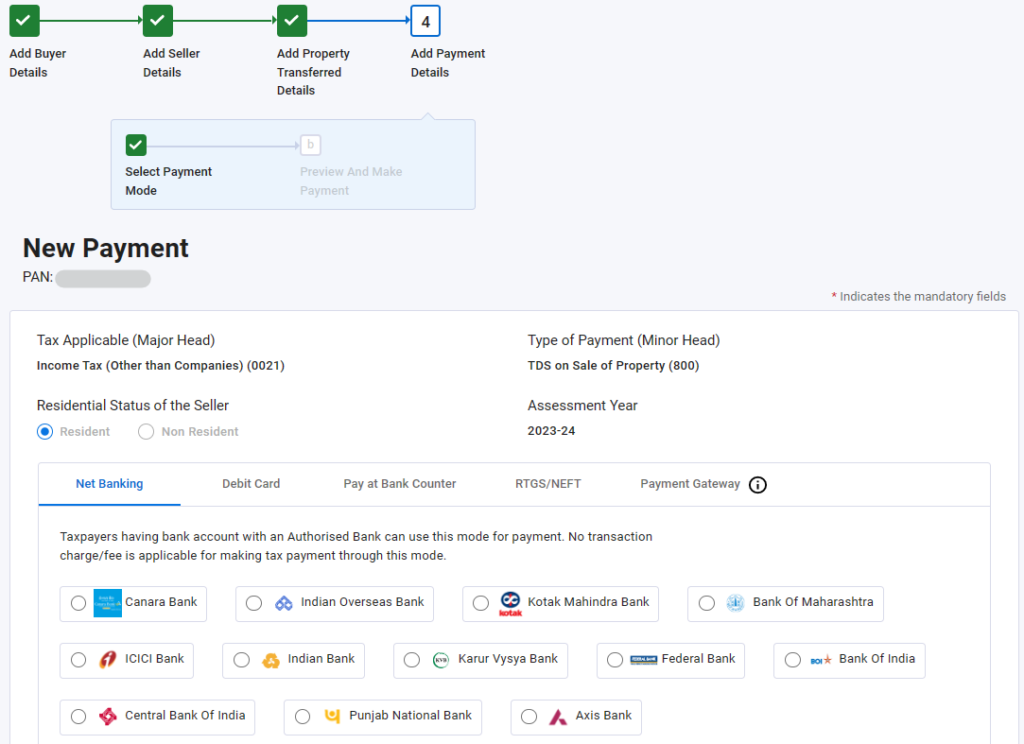

- STEP 8 – Select Bank. In case canNOT find bank then select “Other Bank“

- STEP 9 – Payment Gateway displayed, follow rest of the screens

- STEP 10 – On successful payment, download tax payment receipt or challan

- STEP 11 – 7 Days after the TDS payment, ask Seller to check for TDS data in their “Form 26AS“