Benefit from China’s Economic Re-Opening and Rebound

Bull market is always there somewhere in the world! Chinese equity market have delivered double digit return in recent 3 months period. And this above average returns are possible going forward too. There are Mutual Funds in India focused on investing in Chinese stock market.

As on 31 Dec 2022

| Mutual Fund Name | AUM (Rs Crore) | 1-Month Return | 3-Month Return |

| Edelweiss Greater China Equity Fund | 1,730 | 7% | 28% |

| Nippon India ETF Hang Seng BeES | 146 | 9% | 29% |

| Axis Greater China Equity FoF | 115 | 10% | 29% |

| Mirae Asset Hang Seng TECH ETF FoF | 77 | 9% | 39% |

Shanghai Stock Market : 1-Year Chart

Favourable Data Points for Chinese stock market –

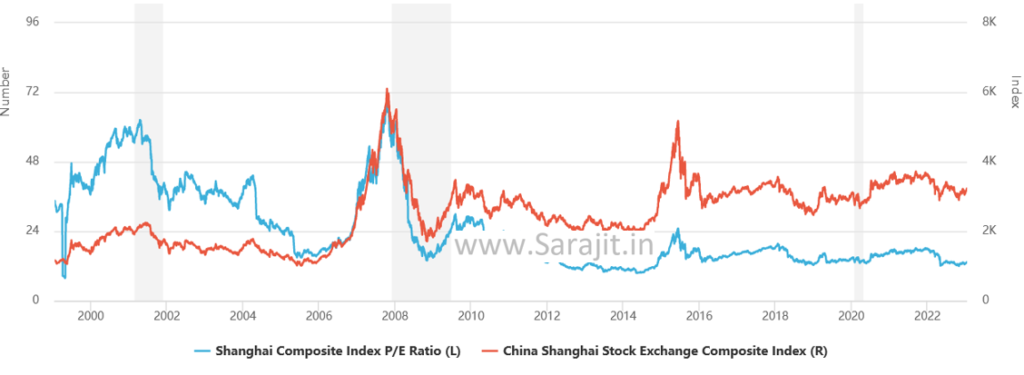

- China Shanghai Stock Exchange Index P/E ( Price to Earnings ratio ) –

- Current (Jan 2023) P/E is 13

- Historical Peak P/Es are 25 in June 2015, 66 in Oct 2007, 60 in May 2001

- Average P/E is 16

- P/E increasing from current 13 to average 16 is increase of 20%+

- China’s weightage in emerging market index have currently dropped to 28% from peak of 35% in May 2021. Normalization of weightage in the index will automatically bring in investments from global investors, taking the Chinese stock market higher

- Global investors’ exit from China in 2022 caused net outflows in excess of $187 billion. Going forward, some or significant part of this money will be back in China, boasting the Chinese stock market

- Chinese government wants the economy to grow at 5.5%. So the government will do everything needed to spur growth, benefiting the Chinese stock market

- Chinese equity is in a unique situation with GDP growing and equity market P/E in low double digits. Chinese interest companies valuation at low double digits forward P/E is attractive given sustainable 20% EPS (Earning Per Share) growth

Shanghai Stock Market : 22-Year Chart

Positive Macro factors for Chinese economy and stock market

- China is the only major global economy which is currently reducing interest rate, whereas globally interest rates are going up. Falling interest rate is good for economy and growth

- Chinese economy is re-opened with removal of Covid restrictions, this should abode well for Chinese businesses. As China reopens, global investors are bound to put money at work in China

- Restrictions, clam-down and scrutiny of Chinese company’s is slowly getting loosened. There is more normalized regulatory environment for Chinese internet companies after the regulatory catch-up over the past few years. Regulatory enforcement will continue, sometimes tighter, sometimes looser, but the major regulatory policies, dons and dos, is already discounted in stocks prices

- Chinese government is working on making the Chinese economy domestic and consumption focused rather than export oriented. A continuation of the drive towards self-sufficiency, doubling down on China’s strategic “Made in China 2025” priorities will support sustainable long term growth of Chinese economy

- EV penetration and development of renewable energy continues to help support energy security. Competitive dynamics and company-specific strengths are key to growth of Chinese companies

- Chinese government and companies have agreed to give access of financial data to US securities institutions for audit of Chinese businesses listed in US stocks markets. This removes the threat of de-listing of Chinese stocks from USA stock markets. This overhang of delisting has been keeping prices of Chinese stocks depressed for last few years

- President Xi’s new standing committee appears to be a very unified group, which will assist clearer and more rapid execution of policy

DISCLAIMER –

Equity/Stock/Share/Mutual Fund investment are subject to market risks. The article/post is NOT an investment advice. The article/post is an opinion. Please do your own research and/OR consult your investment advisor before making your investment. Past performance is not indicative of future returns. Please consider your specific investment requirements before choosing your investments or designing a portfolio that suits your investment needs. The article/post or the author cannot be held responsible for any losses