Online Steps to Pay TDS / TCS Tax

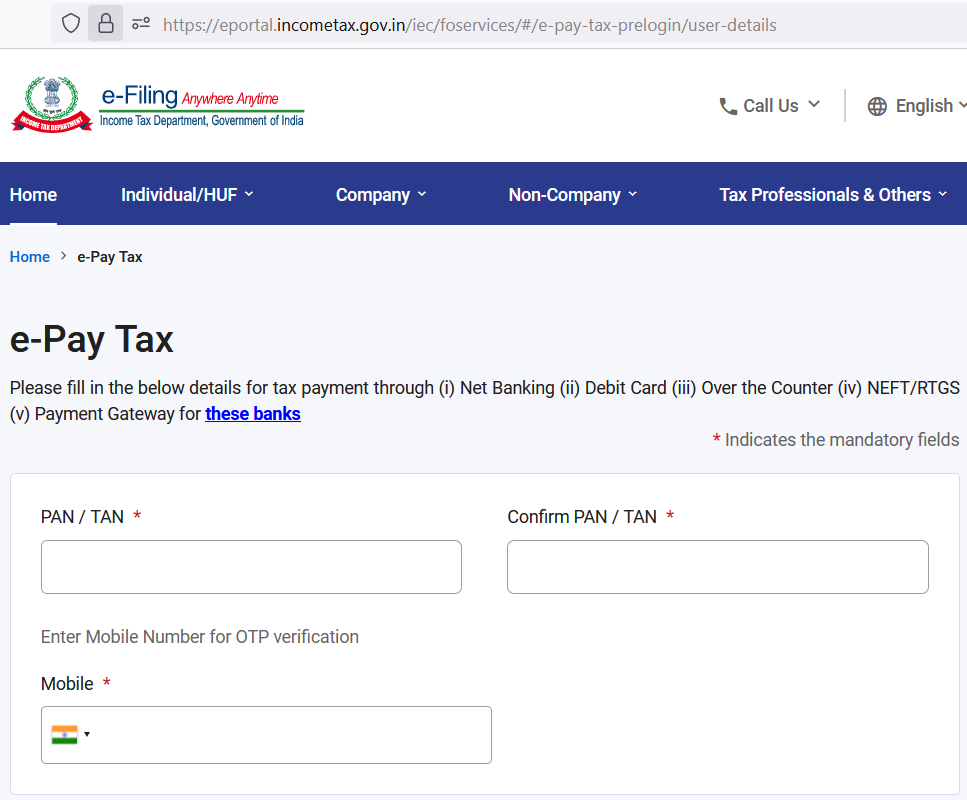

- STEP 1 – Click on this link to Visit Income Tax Payment Portal – https://eportal.incometax.gov.in/iec/foservices/#/e-pay-tax-prelogin/user-details

- STEP 2 – Enter TAN ( Tax Deduction Account Number ) and Mobile

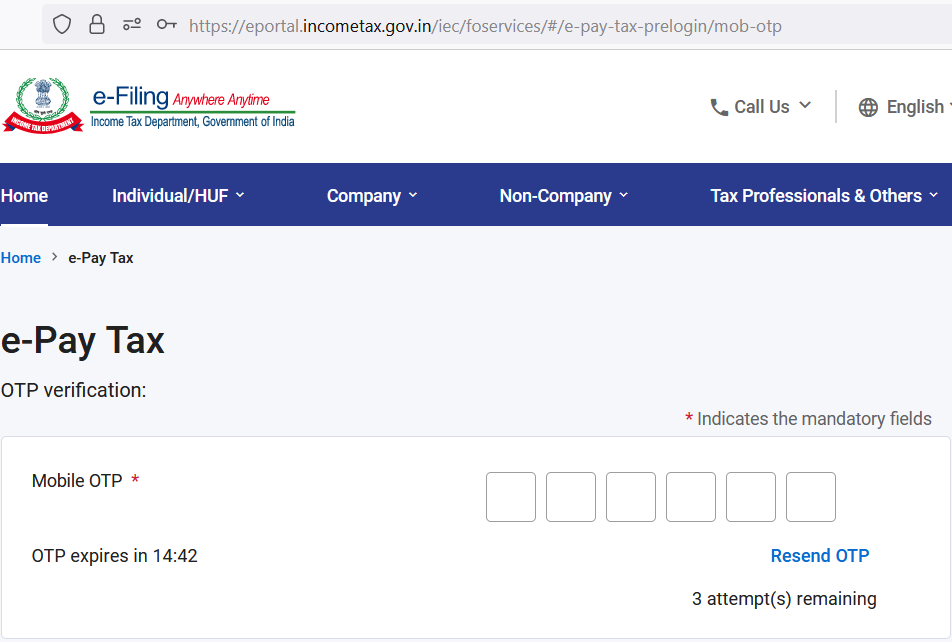

- STEP 3 – Enter OTP received in mobile

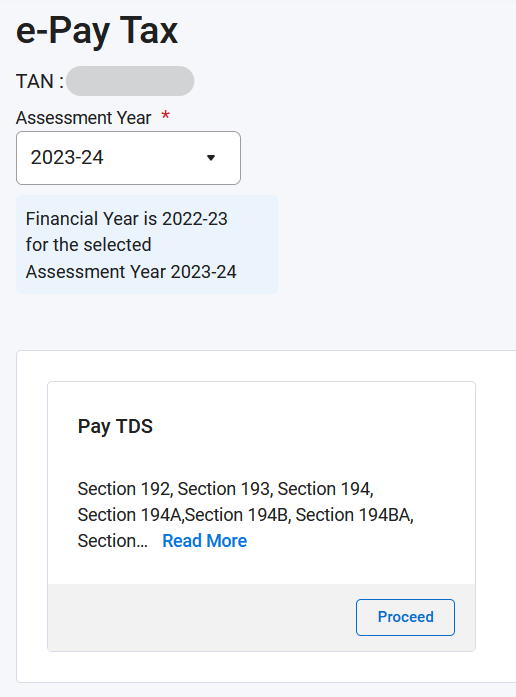

- STEP 4 – Select Assessment Year 2023-24, REVIEW Financial Year information, and click on “Proceed”

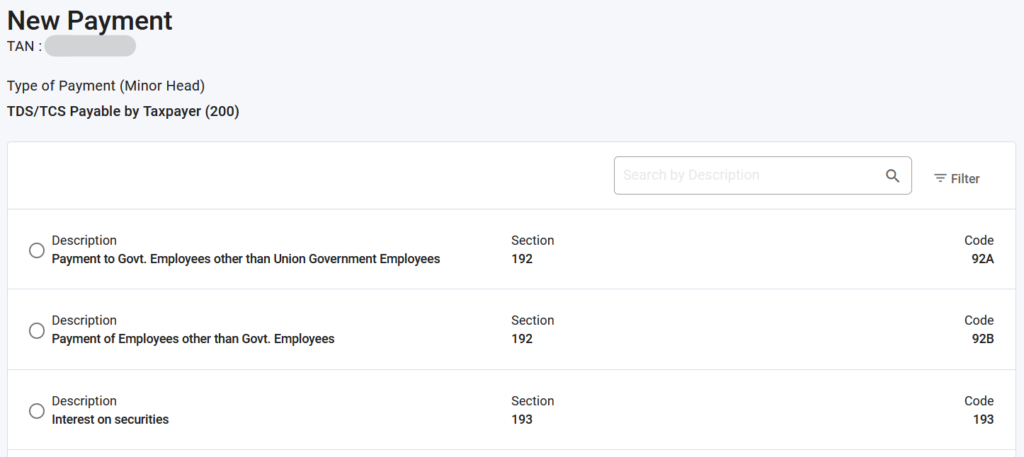

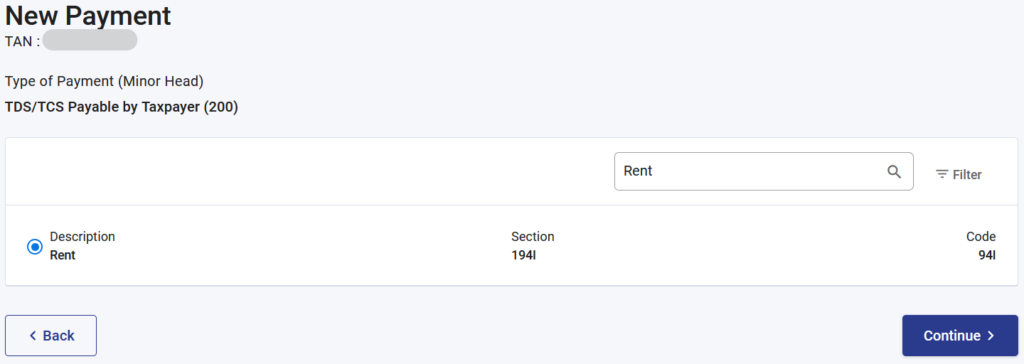

- STEP 5 – In SEARCH box, enter type of tax payment like Rent

- STEP 6 – Select the Description and click on “Continue“

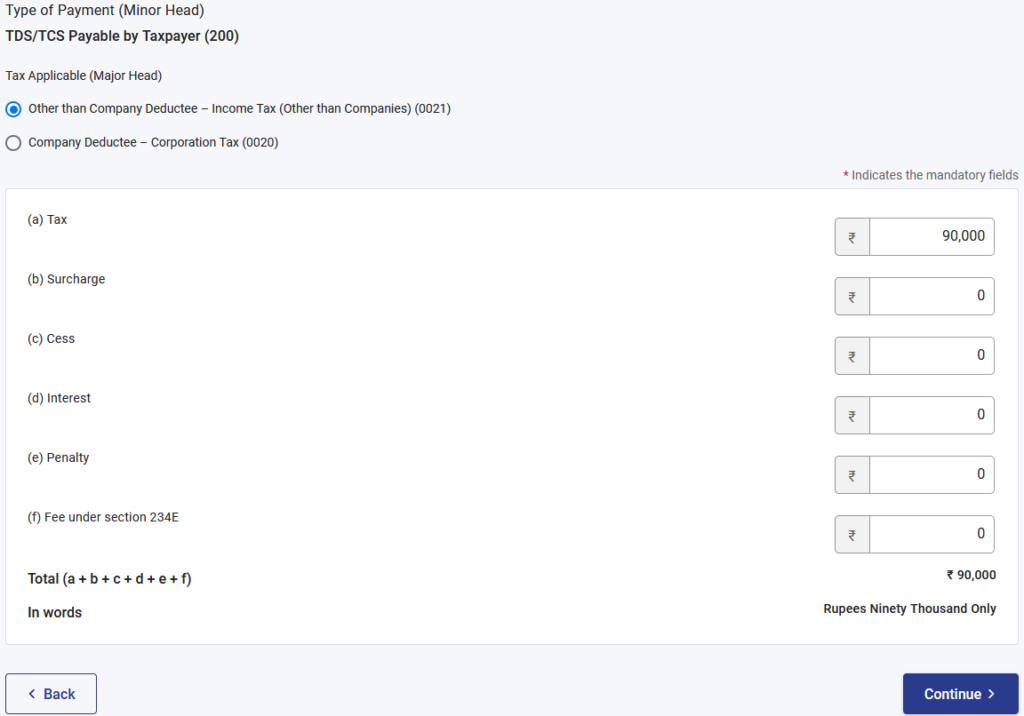

- STEP 7 – Select “Other than Company Deductee” for Individual, enter Tax amount and click on “Continue“

- STEP 8 – Select Bank. In case canNOT find bank then select “Other Bank“

- STEP 9 – Payment Gateway displayed, follow rest of the screens

- STEP 10 – On successful payment, download tax payment receipt or challan