Salaried Tax Payer have number of option Versus MYTH of limited option

For salaried individual income tax is one of the unavoidable realities of life. Income tax becomes even more difficult aspect of life considering the MYTH that salaried individual have very LIMITED options to reduce income tax. In reality salaried tax payer do have NUMBER of options to optimize and reduce tax. Most of the salaried individuals are not even AWARE of all the tax saving options available to them. Let’s go through all the not known available options to salaried tax payer to reduce income tax. Home loan interest & principal, 80C, etc is not discussed, as these are known and very popular.

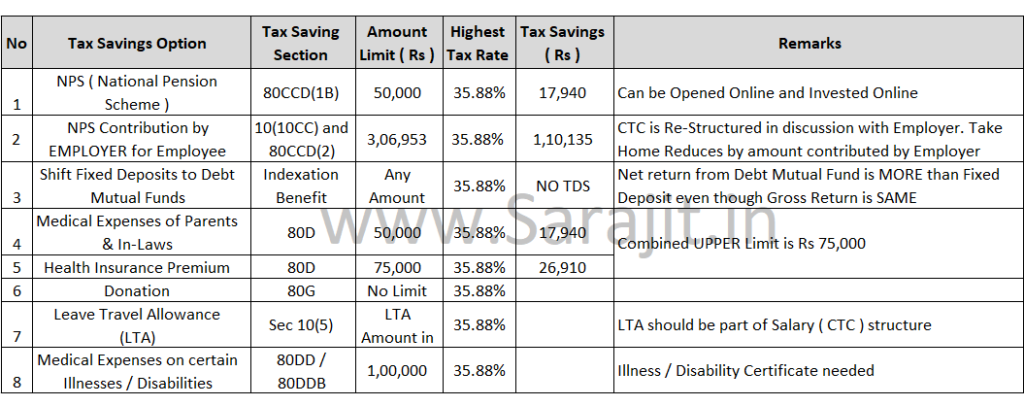

Tax Savings Options, over and above 80C section, are –

- NPS ( National Pension Scheme )

- Saving under section 80CCD(1B)

- Tax saving investment limit Rs 50,000

- Tax Saving is Rs 17,940 in highest tax bracket

- NPS Contribution by EMPLOYER for Employee

- Saving under sections 10(10CC) and 80CCD(2)

- Individual need to Re-Structure her or his salary components, in consultation with HR OR Payroll, to add NPS contribution by employer to avail this benefit

- Employer’s contribution to EPF, NPS and/or superannuation fund upto Rs 7.5 lakh in a financial year is non taxable. 10% of the basic component is also a limit

- On Employer’s contribution of Rs 1.5 lakh, tax savings is Rs 53,820 in highest tax bracket. Tax saving contribution could be Rs 1.5 lakh to 7.5 lakh depending on basic component of salary structure

- SHIFT Fixed Deposit Investment to Debt Mutual Fund

- Saving under Cost Inflation Index (CII) of Indexation Benefit of Section 48

- Interest on FDs is taxable for every tax payer individual. Whereas return from Debt Mutual Fund is tax free after 3 years of investment. Debt Mutual Fund can avail indexation benefit which is NOT available for FDs. Indexation benefit reduces taxation to ZERO

- For example interest rate on FD is 7% per year, this complete 7% interest is taxable. Whereas 7% per year return from a Debt Mutual Fund is not taxable after 3 years. Indexation benefit index is 7%, which nullify the 7% return from Debt Mutual Fund thereby making the taxable return ZERO from Debt Mutual Fund. So tax on this 7% return from Debt Mutual Fund is ZERO

- Tax Saving is 100% on return from Debt Mutual Fund

- Medical Expenses of Parents & In-Laws

- Saving under Section 80D

- Medical expenses and health insurance premium for parents and in-laws can be claimed as deductions

- Limit of Rs 50,000

- Tax Saving is Rs 17,940 in highest tax bracket

- Health Insurance Premium for self, family, parents and in-laws

- Saving under section 80D

- Limit for self and family is Rs 25,000. Limit for parents and in-laws is Rs 50,000

- Donation

- Under section 80G

- No limit on donation amount

- Tax benefit is available on 100% OR 50% of the donation amount depending upon nature of the donee trust

- Leave Travel Allowance ( LTA )

- Under Section 10(5)

- Tax saving is limited to 2 years in a block of 4 years, and also limited to the LTA amount in individual’s salary structure

- Medical Expenses on Certain Illnesses and Disabilities

- Under sections 80DD and 80DDB

- Tax saving limited to expenses of Rs 1 lakh

- Individual needs to follow certain documentation process to claim this tax benefit