Budget FY 2023-24 Reduces Income Tax & Increases Post Tax Income

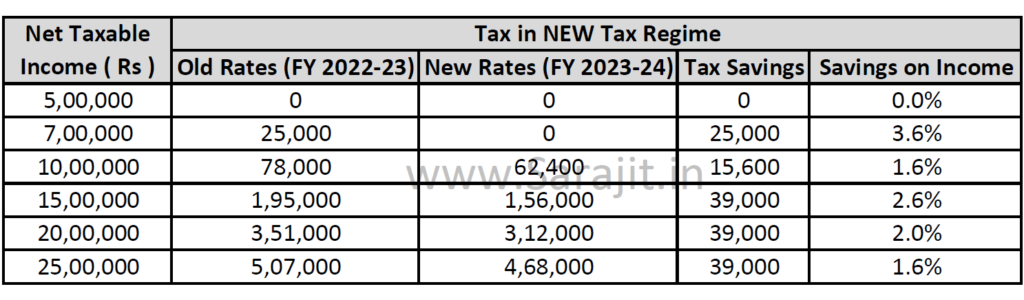

Budget for Financial Year 2023-24 have effectively given increment in income for salaried and individual tax payer. There are number of positive changes in taxation for salaried and individual Tax Payer. The changes delivers 2% to 5% reduction is tax, thereby increasing post tax income by 2% to 5%, which is welcome.

NOTE –

- New Tax Regime for Financial Year 2023-24 ( Assessment Year 2024-25 ) is the same for all categories of Individuals, i.e Individuals & HUF till 60 years of age, Senior citizens above 60 years till 80 years, and Super senior citizens above 80 years. No separate tax rates or exemption limit is available to senior and super senior citizens in the New Tax regime

- The below increase in Post Tax Income is based on comparison of New Tax Regime for FY 2022-23 Vs New Tax Regime for FY 2023-24. Comparison of New Tax Regime for FY 2023-24 Vs Old Tax Regime for FY 2023-24 is a separate discussion!

1) Non-Taxable Income Limit – INCREASED

The Non-Taxable limit is increased to Rs 7 lakh from current Rs 5 lakh in the NEW Tax Regime. As per the New Tax Regime for FY 2023-24, the tax on income of Rs 7 lakh is Rs 25,000. This tax of Rs 25,000 is reduced ZERO by providing REBATE of Rs 25,000 under section 87A.

- Taxable Income Rs 7 lakh

- Total Tax = Rs 25,000

- Income of ₹3 lakh: 0% of Rs 3 lakh = Rs 0 tax

- Income of ₹3 lakh to ₹6 lakh: 5% of Rs 3 lakh = Rs 15,000 tax

- Income of ₹6 lakh to ₹7 lakh: 10% of Rs 1 lakh = Rs 10,000 tax

- Tax Rebate under 87A = Rs 25,000

- Net Tax = NIL

Positive Impact – Tax Savings of 3.5% on income of Rs 7 lakh, which is increase of 3.5% in post tax income

2) Standard Deduction – INTRODUCED

- Standard deduction introduced for salaried, pensioners and family pensioners

- This deduction is available only to those taxpayers who have income under ‘Income from Salaries’. Thus, salaried individuals and pensioners can claim the standard deduction of Rs 50,000 from their salary/pension income

- For family pensioners, standard deduction of Rs 15,000 is available. Income for a family pensioner is taxed under the head ‘Income from other sources’

Positive Impact – Tax Savings of 0.3% to 1% depending on tax bracket, increasing post tax income

3) NPS Contribution Deduction – INTRODUCED

- For salaried individual deduction introduced for “NPS contribution by the employer to employee’s NPS account”, under section 80CCD (2)

- Private sector salaried employee can have a maximum deduction of 10% of basic component of salary. For government employee, the maximum deduction is 14% of basic plus dearness allowance

- Employee can Re-Structure their salary components, in consultation with their HR OR Payroll, to have 10% contribution from Employer to employee’s NPS

Positive Impact – Tax Savings of more than 1% depending on tax bracket, increasing post tax income

4) Tax Rates – REDUCED

| NEW Tax Regime, Tax Rates for FY 2023-24 | NEW Tax Regime, Tax Rates for FY 2022-23 |

| Income of ₹3 lakh: No tax Income of ₹3 lakh to ₹6 lakh: 5% Income of ₹6 lakh to ₹9 lakh: 10% Income of ₹9 lakh to ₹12 lakh: 15% Income of ₹12 lakh to ₹15 lakh: 20% Above ₹15 lakh income: 30% | Income of ₹2.5 lakh: No tax Income of ₹2.5 lakh to ₹5 lakh: 5% Income of ₹5 lakh to ₹7.5 lakh: 10% Income of ₹7.5 lakh to ₹10 lakh: 15% Income of ₹10 lakh to ₹12.5 lakh: 20% Income of ₹12.5 lakh to ₹15 lakh: 25% Above ₹15 lakh income: 30% |

Reduced Tax Rates benefits all income brackets as shared below –

Positive Impact – Tax Savings of 1% to 3.5% depending on tax bracket, thereby corresponding increase in post tax income

5) Default Tax Regime

- New Tax Regime is default tax option. Tax payer have the option to choose the old regime

6) Surcharge – REDUCED

- This is applicable for income of Rs 2 crore and more! This is NOT applicable for most of the tax payers. Maximum surcharge limited to 25% in New Tax Regime compared to 37% earlier

Positive Impact – Tax Savings of 3.6%, significantly increasing post tax income