Genuine HUF is Tax Efficient for Income Generating Assets

Definition of HUF ( Hindu Undivided Family ), as per Income Tax Department of India –

“An HUF is recognized as a separate assessable entity under the Act. Its income may be assessed if following two conditions are satisfied:

- There should be a coparcenership. In this connection, it is worthwhile to mention that once a joint family income is assessed as that of HUF, it continues to be assessed as such in subsequent assessment years till partition is claimed by coparceners

- There should be a joint family property which consists of ancestral property, property acquired with the aid of ancestral property and property transferred by its members. Ancestral property may be defined as the property which a man inherits from any of his three immediate male ancestors, i.e. his father, grandfather and great grandfather. Therefore, property inherited from any other relation is not treated as ancestral property“

HUF – Different Types

Layman meaning of above definition is : A HUF are of following types –

- Ownership of Ancestral Property / Assets – From father, grandfather and great grandfather

- Property / Assets gifted by relatives and friends – Intention of donor and the nature of the gifted property will determine creation of HUF

- Property / Assets received by will of another individual – Documented valid will should exist

- Joint Ownership of property / Assets acquired by persons part of a joint Hindu family

- Larger HUF can be split into smaller HUF

- Separated HUF can rejoin to form larger HUF

- Husband, Wife and Child HUF – Husband and Wife HUF, is created by default at the time of their marriage. For this HUF to be able to avail independent taxation, a 3rd member, one more member which could be their child, needs to be added. This HUF, of husband, wife and child, can avail separate taxation only on those incomes which are generated from assets acquired at the time of marriage, like property, gifts, money, deposits, jewellery, etc. Incomes from assets acquired after marriage canNOT be clubbed with the incomes of HUF. Even when common assets, between husband and wife, acquired after marriage are transferred to HUF, these transferred assets are considered as gift to the HUF. So income derived from this transferred assets is considered income to the individual and not to the HUF

Members of HUF

- Karta – Karta heads the HUF with decision-making responsibilities, is responsible for managing its legal and financial affairs. Any member of the HUF can perform the role of a Karta with the consent of the other members of the HUF

- Coparceners – Coparceners are born into the HUF family

- Members – Members become part of HUF through marriage into the HUF family

Each person, be Karta, Coparceners or Members, of the HUF has an equal right to the all the assets owned by the HUF

HUF – Creation Process

- STEP 1 – Formal HUF Document ( Deed ) : Write a document having the details of the HUF, like list of members of the HUF, the assets of the HUF, the sources of incomes of the HUF, name of the HUF entity, Karta of the HUF, responsibilities of Karta, etc. This document becomes a legal proof of the existence of the HUF entity. There is a standard format for HUF deed document

- STEP 2 – PAN For HUF : Apply and obtain PAN for HUF using the HUF deed and other supporting documents. PAN is needed to open bank account for HUF, carry out financial transactions and to file tax return for HUF. PAN application process is combination of online and offline processes

- STEP 3 – Open Bank Account for HUF : Open bank account using the HUF PAN and HUF Deed

Get in touch for details on HUF Deed and PAN application for HUF

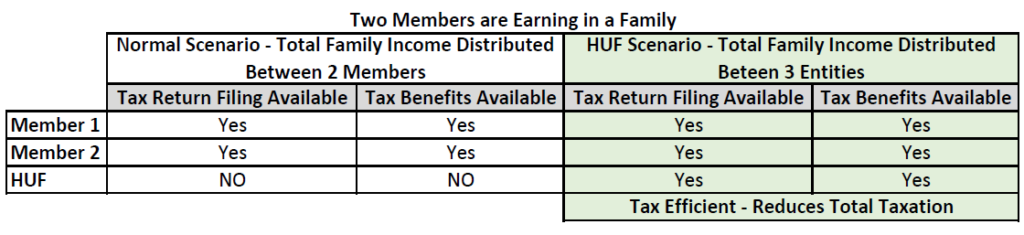

GENUINE HUF – Tax Efficient

Yes, HUF entity is an Independent Entity for taxation. HUF is a legal and an excellent option to reduce tax liability in a family. Separate tax return can be filed for HUF entity. The HUF entity can avail of all the tax deduction benefits as available to individual taxpayer. For example a family of 2 earning members having a GENUINE HUF entity. Now this family can submit 3 tax returns, one additional tax return in name of HUF, instead of 2 tax returns. Basically instead of 2 entities ( the 2 earning members ), there are 3 entities ( 2 earning members and HUF entity ) owning assets, having incomes and filing tax returns. This way instead of 80C deductions of Rs 1,50,000 available only 2 times between the 2 earning members, this deduction can be availed 3 times, between the 2 earning members and the HUF entity.

HUF cannot be created for the single purchase of tax efficiency. As income tax department is always skeptical of taxation and tax return filed for the HUF. There should be crystal clear documented separation of incomes generated from HUF assets and assets of individual members of the HUF.

CONCLUSION

Creating HUF is easy, BUT be careful on claiming taxation benefits for HUF