Hunt is On – Resources Sector Have Potential for Next Bull Market

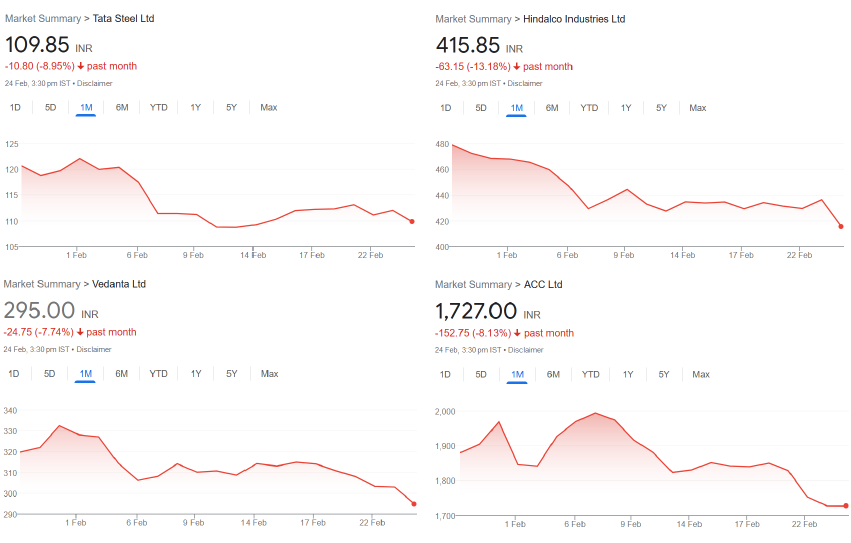

Recent BAD News on Resources Sector –

- Feb 9, 2023 – Hindalco Q3 Results: Profit plunges 65% YoY to Rs 1,362 crore

- Feb 6, 2023 – Tata Steel Q3 Results: Firm reports surprise net loss of Rs 2,224 cr; revenue down 6% YoY

- Jan 27, 2023 – Vedanta Q3 Results: Profit tanks 42% YoY to Rs 3,092 crore

Everything is NOT bad for Resources Sector, there are POSITIVES too –

- Jan 31, 2023 – Coal India Q3 Results: Profit soars 69% YoY to Rs 7,719 crore

- Jan 28, 2023 – NTPC Q3 Results: PAT rises 5% YoY to Rs 4,476 crore

Recent Price Action – Resources Sector

Resources Sector – Contrarian View

“One little contrarian or a little ahead-of-the-curve call would be metals. We have seen really atrocious numbers. As China recovers and we see the Chinese economic recovery gaining traction around June, all of a sudden you will see price action coming back. So I would take some positions in metals in anticipation of a Chinese recovery; the profit numbers were very poor, margins fell down because of pricing going off, I think global pricing will come back to metals and that will help our metal producers as well.” – Neelkanth Mishra of Credit Suisse

“In its recent report, global brokerage firm JP Morgan had said that the Indian steel companies are ‘well positioned’ despite an overall negative sentiment by investors. With the weak 3QFY23 earnings out of the way, fundamentals improving and ownership below trend, we see a positive environment for Indian steel stocks.”

History OR Anecdote on Bull Markets

Technology companies had a bull market for 2 decades, as shown in NASDAQ chart below. Technology companies will continue to grow, but the phase of above average growth rate is over. Technology companies have become matured businesses, and matured companies are never part of bull markets.

Energy companies were the worst performing sectors for close to 2 decades till 2020. Energy companies had a bull market in 2021-22, as shown in Energy Index chart below. Rise in Crude price to $100 OR higher, can continue the bull market in energy companies.

Every new bull market, in history, had a bullish sector which was NOT part of recent, latest bull market. Sector or companies of the recent bull market are never part of subsequent bull market. Every new bull market have NEW sectors, NEW companies, NEW leaders. New or subsequent bull markets have never been lead by previous bull market leaders. So it is highly unlikely that Technology companies OR Energy companies will lead the next bull market.

Search for next bull market sector or companies is on, and need is there to identify new companies or sectors or leaders for next bull market. One sector having potential to lead the next bull market in 2023 OR going forward is resources sector. Resources sector is represented by Mining Companies like Coal India, ONGC, Integrated Material Processing Companies like Tata Steel, Hindustan Zinc, Value Adding Companies like Ultra Tech Cement, ACC.

Positives for Resources Sector

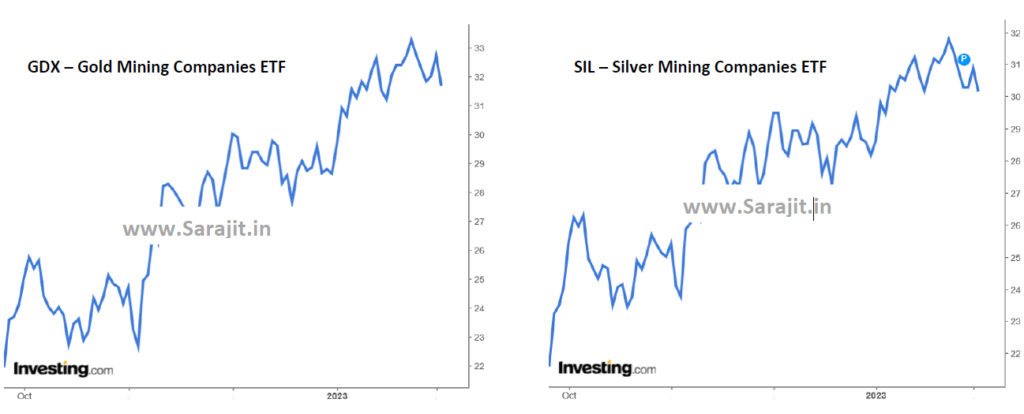

- Fall in Dollar Index – Dollar Index have fallen recently and is expected to keep falling, which is favourable for prices of resources. All resources are priced in Dollar Index, and prices of resources are negatively ( inversely ) related to Dollar Index. Falling dollar index increases the prices of resources, which benefits resources companies. Some of this is already visible in performance of Gold and Silver mining companies from Oct-2022 to Jan-2023 as shown in below charts

- Demand Outpacing Supply & New Discoveries – Known exploitable resources deposits are depleting faster than discovery of new deposits. This ensures increase in supply of new resources is slower than the pace of increase in demand for resources, ensuring demand will always outpace supply, thereby giving resources companies pricing powers

- China Re-Opening abodes well for resources companies. Growing India is also consuming increasing amounts of resources

- Global Growth, GDP growth, by default increases consumption of resources, providing sustainable growth for resources companies

- EVs and Electrification needs lots & lots of copper and other resources. Increase in copper demand is outpacing the increase in supply of copper, this will keep copper prices elevated, boosting resources companies

- Prudent Capital Utilization – Resources companies have become efficient allocator of capital during COVID. Plus resources companies are returning capital back to shareholder, thereby boosting stock prices

- Higher Benefit on Profit Margin – Increase in prices of resources and resource’s company profit margin is positively related by more than degree of two ( 2 ) or more. That is, when prices increases by 1%, the profit margins of companies increases by 2% or more increasing the net profit significantly

- Expansion of P/E – Bull markets are supported by increase in P/E values of companies. Most of the resources companies current stock prices are below their historical P/E values. Increase in P/E values back to historical level will increase their stock prices

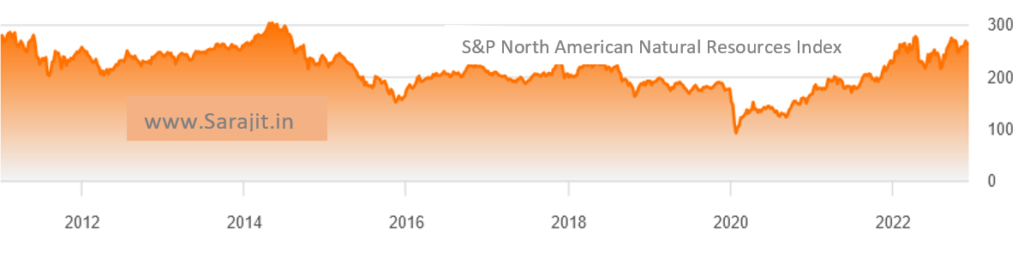

- Law of Averages and Contrarian View – Resources companies have delivered poor returns over past decade as shown by “S&P North American Natural Resources Index (SPGSSINR)”. Law of averages are in favour of resources companies doing well

Investment Options

As on 31 Jan 2023

| Fund Name | 3-Month Return | AUM ( Rs Crore ) |

|---|---|---|

| DSP World Gold Fund | 33% | 809 |

| DSP Natural Resources and New Energy Fund | 8% | 697 |

| ICICI Prudential Commodities Fund | 4% | 768 |

| CPSE ETF | -2% | 19,387 |

| SBI Magnum COMMA Fund | -4% | 446 |

| Tata Resources and Energy Fund | -6% | 239 |

DISCLAIMER –

Equity/Stock/Share/Mutual Fund investment are subject to market risks. The article/post is NOT an investment advice. The article/post is an opinion. Please do your own research and/OR consult your investment advisor before making your investment. Past performance is not indicative of future returns. Please consider your specific investment requirements before choosing your investments or designing a portfolio that suits your investment needs. The article/post or the author cannot be held responsible for any losses