3 or More Assets Diversification, Conservative Investment in Any Weather

One of the primary principal in investment portfolio of an individual is diversification. Diversification in the portfolio is achieved by investing into different asset classes of Fixed Income, Equity, Gold, Cash, Real Estate, Global Equity, etc. Managing and operating a diversified portfolio, like re-balancing, booking profit, changing asset allocation, etc is easier said than done, that is it is cumbersome and challenging for an average individual investor. Individual investor lack the expertise, knowledge, experience and time to manage and operate a diversified portfolio. The solution to this problem is – “Multi Asset Mutual Fund“.

Performance of Multi Asset Fund

- Return, over 5 years period, as on 31 Jan 2023 among all the available Multi Asset Funds

- 20% MAXIMUM per year return

- 12% AVERAGE per year return

- 7% MINIMUM per year return

- Superior risk adjusted return over all market conditions and over long periods, justifying the diversification feature of the product

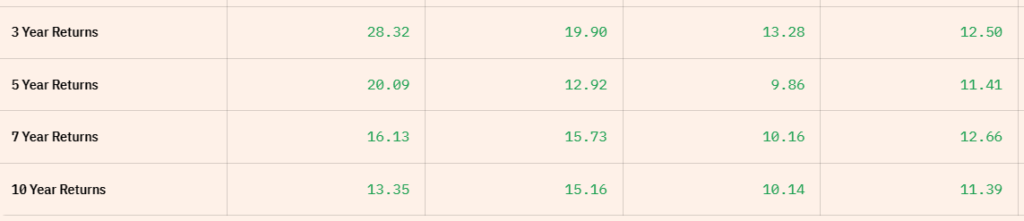

Superior Return Over Long Period, 3 years to 10 Years

Ideal for Lumpsum ( Single ) Investment at Any Time and in Any Market Conditions

- Multi Asset Mutual Fund is conservative and less volatile investment, because of its diversification feature, compared to Equity products making Multi Asset Mutual Fund an excellent choice for lumpsum investment

- Asset allocation of Multi Asset Fund at any time is based on the prevailing market conditions, thereby eliminating the need to time the investment. This makes Multi Asset Fund an all weather fund : investment in Multi Asset Fund can be done at any time without worrying about the market conditions. The fund manager orients the composition of different asset classes based on her/his professional experience and market conditions

Diversification Into 3 OR More Asset Classes

- Invests in at least three asset classes with a minimum allocation of at least 10% each in all three asset classes

- Invests into asset classes of Equity, Debt, Gold & Silver, Cash, Real Estate, Global Equity, etc. Thus Multi Asset Mutual Fund is a SINGLE product providing investment diversification into all available asset classes

- Basically an individual investor can outsource the headache of diversification by investing in a single product managed by a professional fund manager

Typical Asset Allocation of Multi Asset Fund

Protects Investor from Recency Effect OR Recency BIAS

- Multi Asset Mutual Fund addresses the “Recency Effect” too. Individual investor invests into an asset class after it had already done well, which is not a prudent investment approach. Historically when an asset class have done well for a period of time, the same asset class does not perform well for a subsequent period

- For example, technology stocks and funds did very well during 2020-2021, so individual investors made investments into technology funds in 2022, which have back fired! As technology funds have given double digit NEGATIVE returns in 2022. Chasing & investing TODAY into the best performing stock or funds of YESTERDAY is “Recency Effect OR Bias”

- Recency effect is one of primary reasons for getting poor returns for individual investor, and then subsequent disillusionment of individual investor with equity investment!

- Multi Asset fund removes the recency effect by re-balancing or booking profit or changing the asset classes mix in the fund accordingly to market conditions, thereby protecting the fund from poor performances or significant falls during difficult and challenging market conditions

Taxation

- Taxation is like a debt mutual fund, as the equity component, at times, does fall below 65% which is needed for availing equity mutual fund tax treatment

- Investment Period LESS than 3 years – Profit is treated as short-term capital gain, and taxed as per individual’s tax bracket

- Investment Period EQUAL TO or MORE than 3 years – Profit is treated as Long-term capital gain, and taxed a rate of 20% with indexation benefit

Investment Options

As on 31st Jan 2023

| Name | AUM | 5-Year, Per Year Return |

|---|---|---|

| Quant Multi Asset Fund | 604 | 20% |

| ICICI Multi Asset Fund | 15,770 | 13% |

| HDFC Multi Asset Fund | 1,636 | 10% |

DISCLAIMER –

Equity/Stock/Share/Mutual Fund investment are subject to market risks. The article/post is NOT an investment advice. The article/post is an opinion. Please do your own research and/OR consult your investment advisor before making your investment. Past performance is not indicative of future returns. Please consider your specific investment requirements before choosing your investments or designing a portfolio that suits your investment needs. The article/post or the author cannot be held responsible for any losses