Necessary data and document for Income Tax Return Filing

Sale of mutual funds results in Capital Gains OR Capital Loss. Capital Gains detailed data, from sale of mutual funds during the financial year, is needed to compile and file income tax return. CAMS and KFinTech are the two registrars ( data keepers ) of all mutual fund transactions in India. Listed below are the ONLINE steps to download detailed Capital Gains Statement from Sale of Mutual Funds during a financial year.

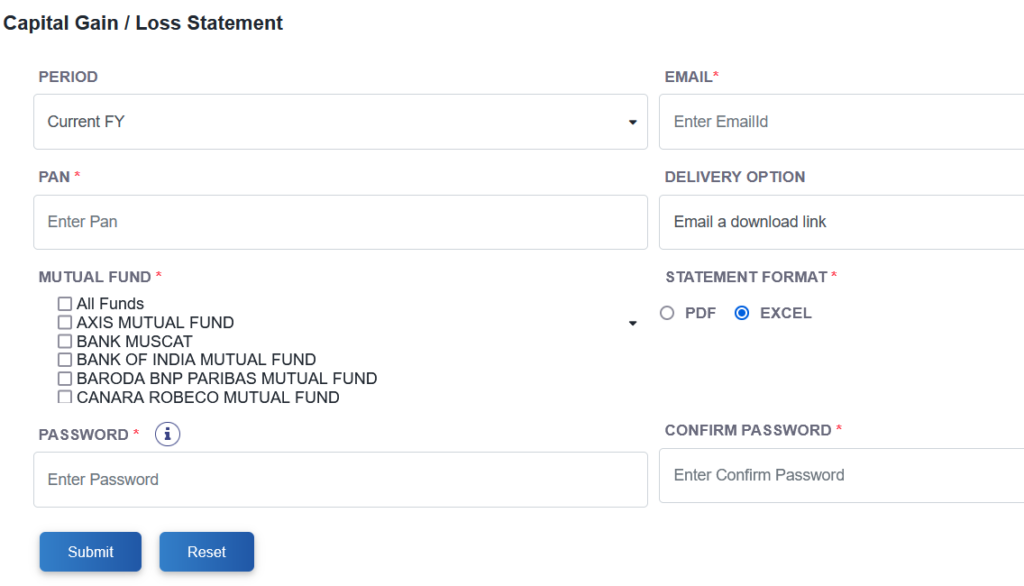

CAMS

- Visit URL – https://www.camsonline.com/Investors/Statements/Capital-Gain&Capital-Loss-statement

- Select OR Enter data as below –

- PERIOD – Select the financial year

- PAN – Enter PAN number

- MUTUAL FUND – Select “All Mutual Funds”

- EMAIL – Enter email

- DELIVERY OPTION – Select delivery option

- STATEMENT FORMAT – Select “EXCEL” as data in excel format is editable

- PASSWORD – Enter any random password, this password will be needed to open the delivered capital gain statement. Make a NOTE of this password

- CONFIRM PASSWORD – Re-Enter the previously entered random password

- Submit – Capital Gain Statement is delivered to email

- NOTE – Email delivery can take few minutes to one day, so be patient

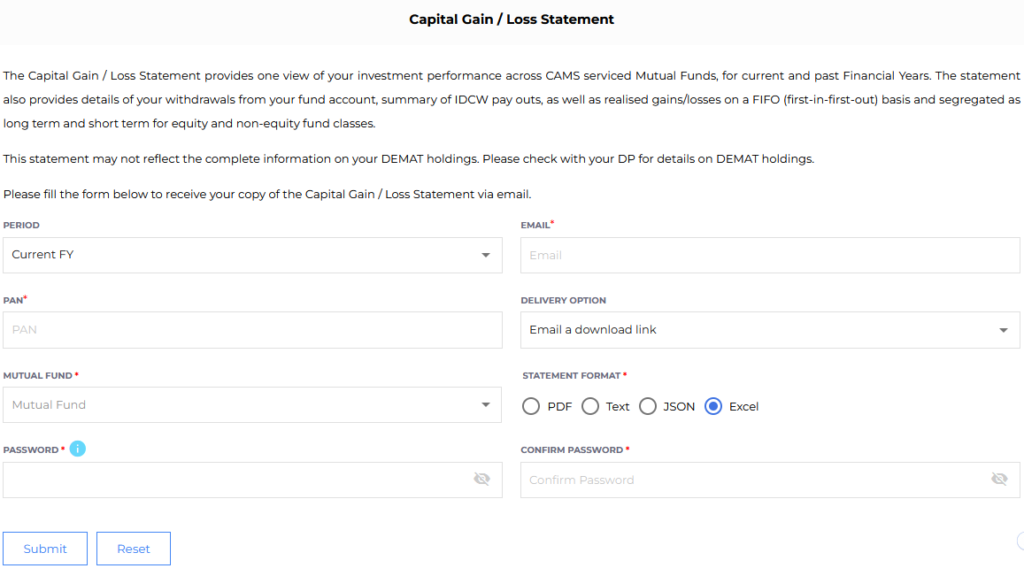

KFinTech

- Visit URL – https://mfs.kfintech.com/investor/General/CapitalGainsLossAccountStatement

- Select OR Enter data as below

- PERIOD – Select the financial year

- PAN – Enter PAN number

- MUTUAL FUND – Select “All Funds”

- EMAIL – Enter email

- DELIVERY OPTION – Select delivery option

- STATEMENT FORMAT – Select “EXCEL” as data in excel format is editable

- PASSWORD – Enter any random password, this password will be needed to open the delivered capital gain statement. Make a NOTE of this password

- CONFIRM PASSWORD – Re-Enter the previously entered random password

- Submit – Capital Gain Statement is delivered to email

- NOTE – Email delivery can take few minutes to one day, so be patient