4% Post Tax Return is a BAD financial investment Vs 6% Post Tax Return

For individual in any tax payable bracket, Fixed Deposit is not a good investment for period of 3 or more years. Rather for a tax payable individual fixed deposit is NOT even a saving, as returns from fixed deposit is lesser than inflation, thereby fixed deposit is effectively reducing the value of the money.

Let’s do simple financial math –

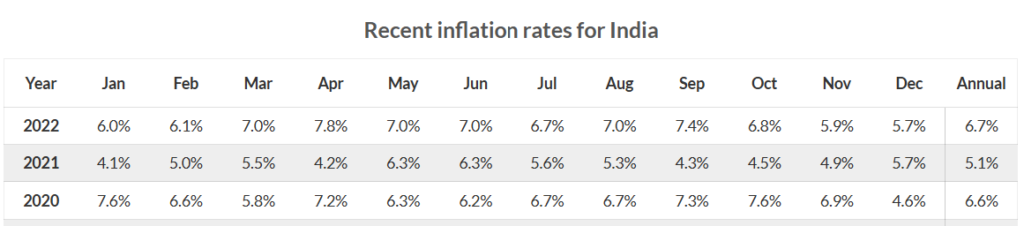

- Return on 1-year fixed deposit from any big bank was 6% in 2022

- Inflation for 1-year period Jan-2022 to Dec-22 was 6.7% ( refer to inflation date above )

- Return of 6% earned on fixed deposit is lesser than inflation of 6.7%, so effectively money in the fixed deposit lost value

- This is NOT the worst part of financial math –

- For individual in higher tax bracket, the tax rate is around 31%

- 31% of 6% return is 1.7%

- So tax eats up 1.7% return out of gross return of 6%

- The net return is 6% – 1.7% = 4.3%

- The post tax return from fixed deposit is 4.3%, which is way below inflation of 6.7%

- The data speaks for itself that fixed deposit is not a sound investment

Now the obvious question is what is the alternate ?

- Investment Period 3 Years OR More – Yes, there is an alternate for money invested for 3 or years – Money Market Mutual Fund. Money Market Fund provides better post tax return for investment period of 3 or more years

- Investment Period Less than 3 Years – Yes, there is an alternate for money, invested for lesser than 3 years, available efficient than fixed deposit, that is topic of another article !

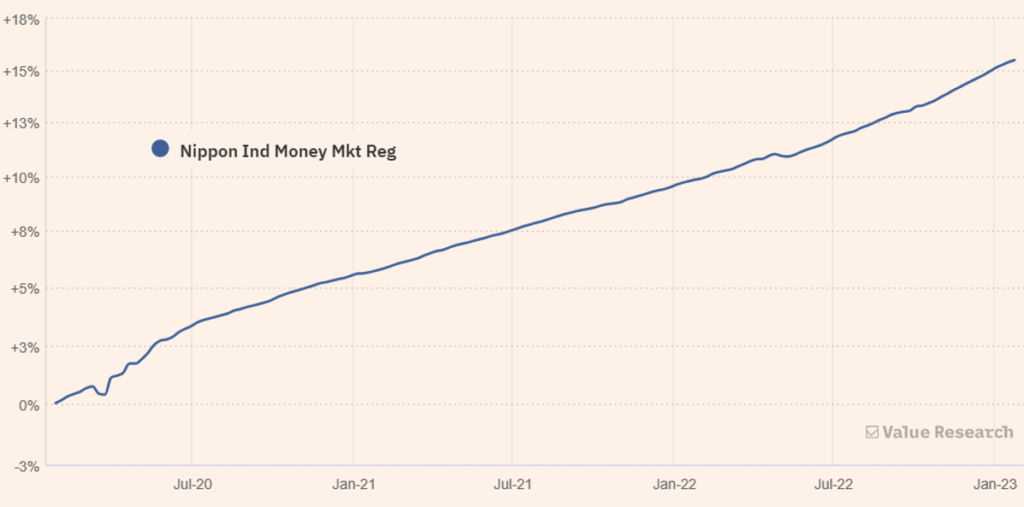

Return from Money Market Fund over 3 year period of 2020 to 2022

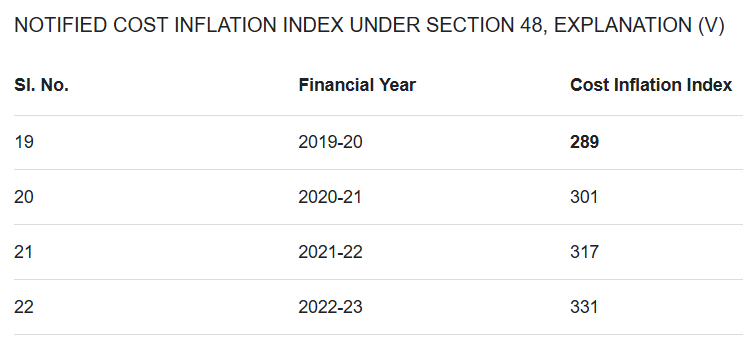

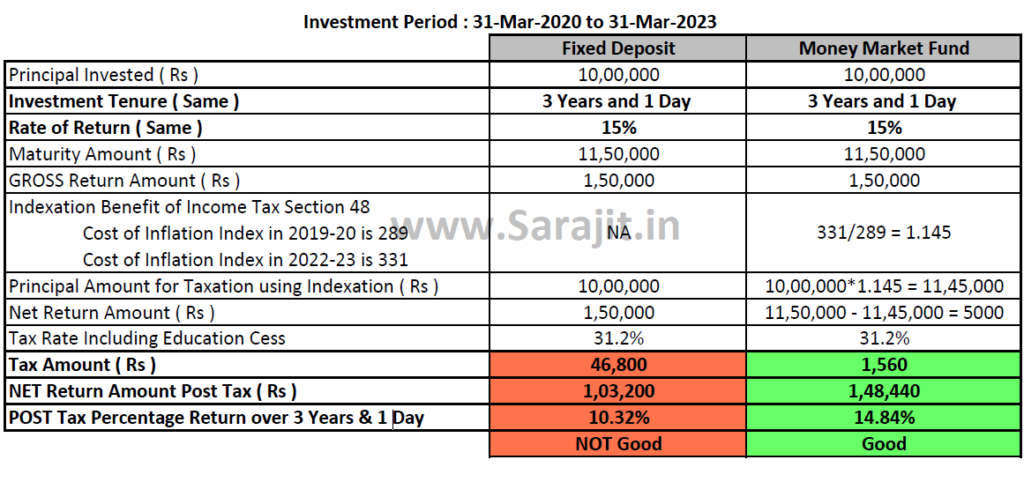

Money Market Fund – “Indexation Benefit” makes it Tax Efficient

Money Market Fund investment for a period of 3 or more years have an additional tax incentive of “Indexation Benefit“. Let’s understand financial math of Indexation Benefit –

Conclusion – 3 years or more, Fixed Deposit is NOT a good investment

Basics of Money Market Fund

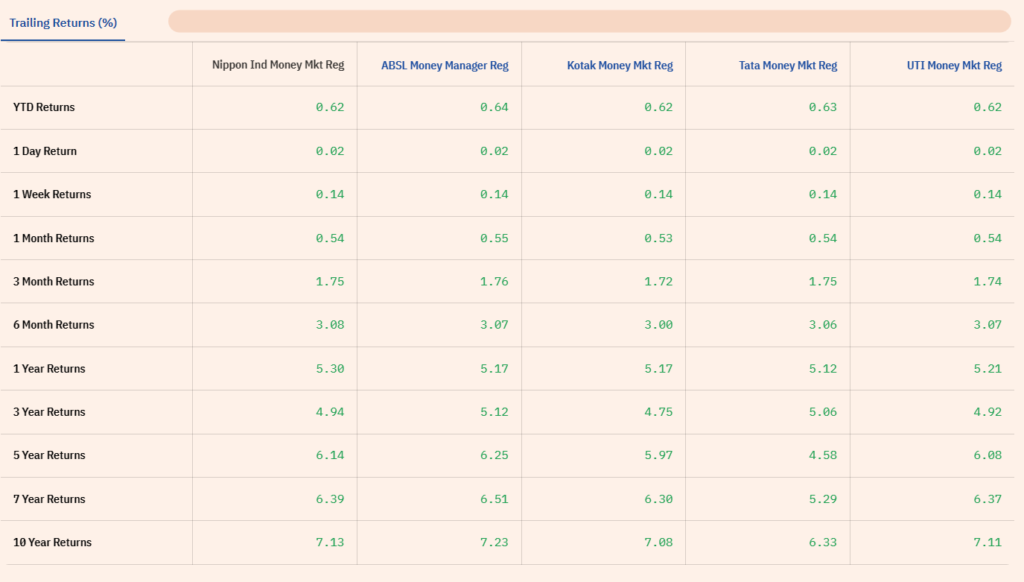

Return from any Money Market fund is positive for all periods, daily, weekly, monthly, quarterly, half-yearly, as shown in the below data

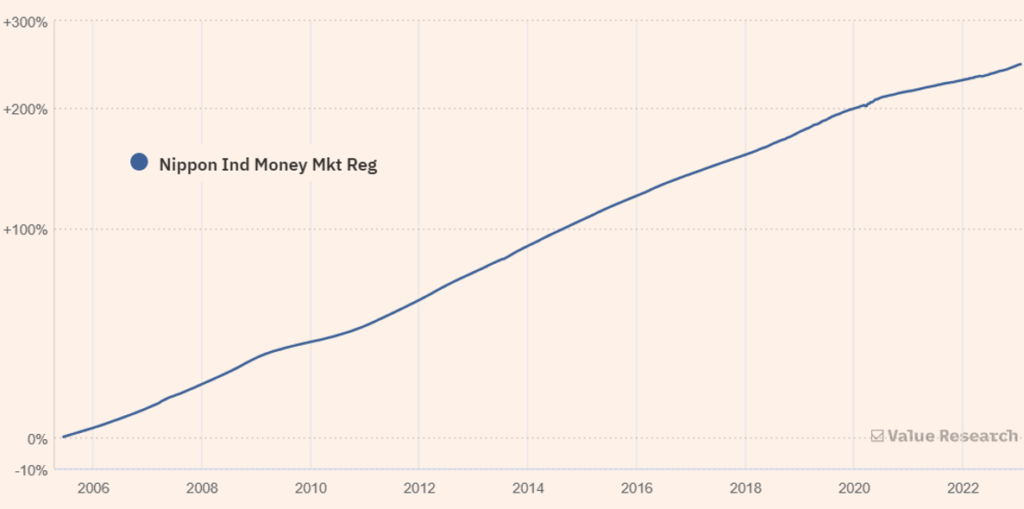

Return from Money Market Fund, is positive for any 3 years period as shown by the historical return chart over a period of 16 years, from 2006 to 2022

- Money Market Fund unlike Fixed Deposit does not guarantee return upfront

- Money Market Fund do NOT invest into Equities or stocks. Money Market Fund invests into NON Equity instruments like debt instruments, Treasury Bills, Bonds, Debentures, etc, of short duration of 3 to 6 months

- Money Market Fund investment objective is to preserve the invested principal and generate return similar to a fixed deposit of 6 to 12 months period