Confusion, Understanding, Options, Impact of Higher Pension from EPS

News on 20 Feb 2023 of “EPFO issues circular on higher pension” has created confusion among salaried individuals! As salaried individual does NOT have much understanding of the Employee Pension Scheme (EPS). Let’s demystify Employee Pension Scheme (EPS), understand the concept of Higher Pension from EPS and EPS options available.

Deadline to Opt for Higher Pension – 26 June 2023

The deadline is 26 June 2023 to opt for Higher Pension from EPS. The application process to opt for higher pension is be completed by 26 June 2023. Government process does take time. So get going IMMEDIATELY with the application process if interested in opting for higher pension from your EPS account, so as to complete by 26 June 2023. Starting on 26 June 2023 will NOT help!

Impact of Higher Pension for EPS – Positive and Negative

Opting for Higher Pension from EPS seems to be optional, NOT mandatory. So there are two possibilities-

- Choice 1 : Opt for Higher Pension from EPS – Increase in pension from EPS will be accomplished by transferring part of past contributions from the EPF account and part of the future contributions of the EPF account to the EPS account.

- Positive Impact on EPS – The monthly pension increases

- Negative Impact on EPF – The current EPF Balance will decrease, and future EPF accumulation will be lesser compared to NOT opting for higher pension

- Choice 2 : NOT Opt for Higher Pension from EPS –

- Status Quo in EPS – The monthly pension does not increase

- Status Quo in EPF – The current EPF Balance will not decrease, and and future EPF accumulation will not be lesser

Guess, it is a catch-22 scenario!

Increase in Pension from EPS

EPS pension calculation formula is –

- Monthly pension amount = ( Monthly Pensionable Salary X Pensionable Service ) / 70

- Monthly Pensionable Salary means the average of the last 60 months’ salary before retirement

- Pensionable Service means the number of years contributions were made to the EPS account. If an employee superannuates at 58 years after rendering pensionable service of more than 20 years, a weightage of 2 years will be added to the service period. However, the maximum pensionable service is limited to 35 years

Case Study –

- Average monthly basic salary Rs 50,000 for the 60 months before retirement

- Service of 25 years before retirement

| Option | Pensionable Salary (Rs) | Pension Per Month (Rs) | EPF Corpus |

|---|---|---|---|

| 1 – NOT Opting for Higher Pension | 15,000 (Maximum Limit) | 15,000 x 25/70 = 5,357 | No Change |

| 2 – Opting for Higher Pension | 50,000 (Actual Salary) | 50,000 x 25/70 = 17,857 | Lesser |

Employee Pension Scheme (EPS) – Background, Confusion & Clarification

Background

Salaried individuals are members of Employees’ Provident Fund Organization (EPFO). Salaried Individuals or member of EPFO are entitled to pension after retirement. Employee and employer each contributes 12% of employee’s BASIC component of monthly salary to EPFO office. For central government employee it is 12% of BASIC and Dearness Allowance. The corpus to pay pension is accumulated during with working years as below –

- 12% of employee’s contribution goes entirely to Employee Provident Fund ( EPF )

- Out of employer’s 12% contribution, 8.33% goes to the Employee Pension Scheme (EPS) and rest 3.67% goes to the EPF

- The 8.33% EPS contribution to Employee Pension Scheme ( EPS ) is capped at Rs 1,250 per month. This maximum monthly limit is based on 8.33% of basic salary of Rs 15,000 per month even when the employee has a higher salary

- The Member ID of the EPF account acts as the EPS account as well. EPF, as well as, EPS contributions are deposited under the same Member ID

Confusion

All the confusion is about this maximum contribution limit of Rs 1,250 per month to EPS. For example –

- An employee’s monthly basic salary is 50,000

- Employer is contributing 8.33% pf 50,000 = Rs 4,165 to EPFO for the EPS contribution

- EPFO is accounting only for Rs 1,250 as the EPS contribution and

- Rest of Rs 2,915 ( 4,165 – 1,250 ) is being accounted as EPF contribution

Do NOT worry, 3.67% of employer’s contribution is still getting accounted in EPF contribution

Clarification

The latest circular from EPFO office addresses the above confusion by specifying that the actual EPS contribution will be accounted in EPS instead of limit of Rs 1,250. That is for above example the EPS contribution will be considered as Rs 4,165 instead of Rs 1,250.

As usual, with government processes, there is always a catch. The consideration of actual EPS contribution will NOT happen automatically, employees have to follow the process mandated by the EPFO office. Employee can get in touch with their respective HR OR Payroll OR Finance department to understand and execute this mandate process. EPFO have also initiated an online process to opt for higher pension from EPS.

Online Process to Opt for Higher Pension from EPS

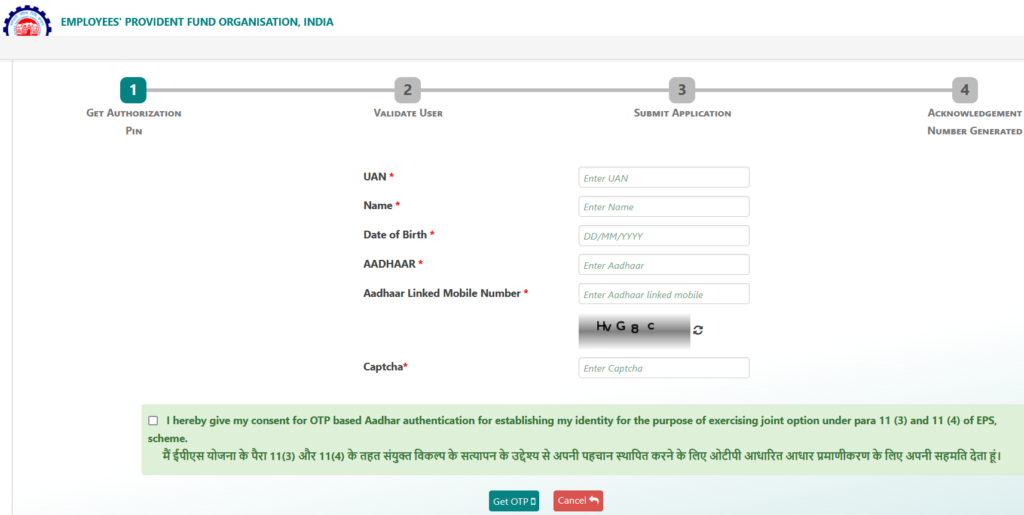

Prerequisites to avail the ONLINE process –

- Employee should have UAN (Universal Account Number). Member’s Aadhaar number, Name and Date of birth should be as available in EPFO records

- Member should have a valid Aadhaar linked mobile number

EPFO have mandated an ONLINE process to consider actual EPS contribution –

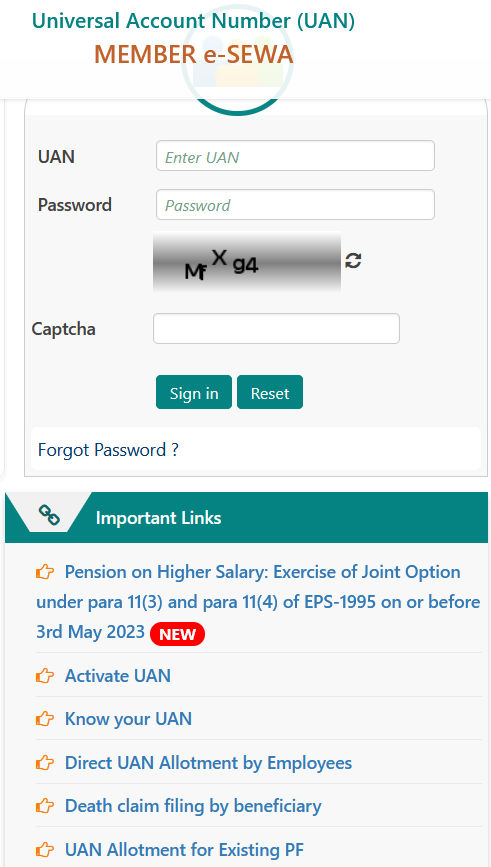

- Step 1 – Login to EPFO Portal

- NOTE – Be Patient with Loading of these Pages OR Try Again !

- Already Registered – https://unifiedportal-mem.epfindia.gov.in/memberinterface

- NOT Registered – Click on “Click Here” on page https://unifiedportal-mem.epfindia.gov.in/memberInterfacePohw/member

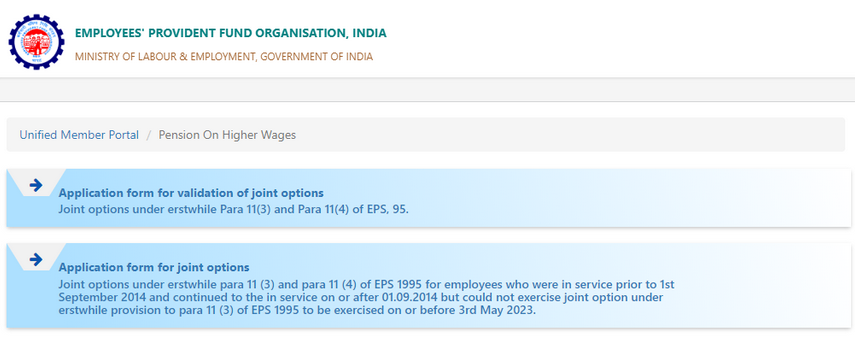

- Step 2 – Fill the Joint Declaration form. This form is called Joint Declaration Form, as this form needs to be first filled by employee and then also need to approved by the employer

- Step 3 – Forward Joint Declaration form to Employer. On submission of Joint Declaration Form by employee, the form will be forwarded to employer for approval. The EPFO will digitally register each application and provide the receipt number to the applicant. It will forward the applications to the respective employers, who will verify them through e-sign/digital signature for further processing. The RPFC will convert all applications into e-files

- Step 4 – Employer Approves the Form. The employer, alongwith approving the form, will also provide proof OR documentation of actual EPS contributions transferred to the EPFO

- Step 5 – EPFO Reviews the Form and Documentation. In EPFO, on receipt of approval and EPS contribution documentation, the concerned dealing assistant will examine the papers and forward the case to the section account officer/supervisor. The concerned account officer/supervisor will examine and send them to the Assistant Provident Fund Commissioners (APFC)/RPFC-II

- Step 6 – EPFO Approves and Acts. The APFC/RPFC-II will examine the case and send the higher pension decision to the applicants via email, post, phone or SMS. And will transfer the relevant amount from the employee’s EPF account to employee’s EPS account

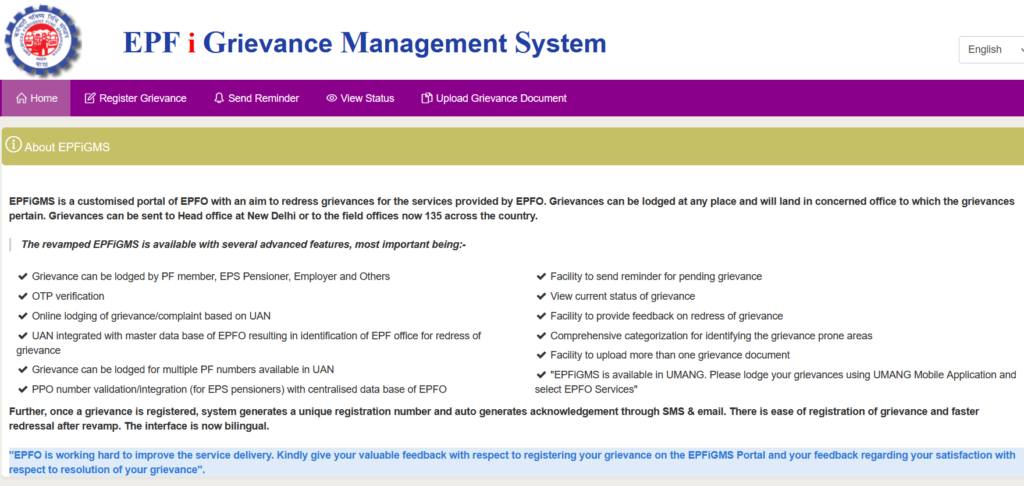

- Step 7 – Grievance. EPFO have enabled ONLINE compliant logging mechanism, at portal https://epfigms.gov.in (EPFiGMS), to register issues faced by employees and employers during the above process. An employee can raise complaint on EPFiGMS when they face a grievance to get a higher pension after submitting the application and payment of the due contribution

EPFO Login Page

EPFO NEW Registration Page

Joint Form Declaration Page

EPFO Grievance Page

DISCLAIMER –

The article/post is NOT an advice. The article/post is a Personal OPINION. Please do your own research and/OR consult your advisor before making any decision. The article/post or the author cannot be held responsible for any losses.