Online Steps to fulfill Government’s extended date to link by 30-June-2023

Latest Statue from Income Tax Department – “CBDT has extended the deadline of linking of Aadhaar with the PAN from 31st March 2023 to 30th June 2023“

Original Statue from Income Tax Department – “As per CBDT circular F. No. 370142/14/22-TPL dated 30th March 2022, every person who has been allotted a PAN as on 1st July 2017 and is eligible to obtain Aadhaar number is required to link PAN with AADHAAR on or before 31st March, 2022. Taxpayers who failed to do so are liable to pay a fee of Rs. 500 till 30th June, 2022 and thereafter a fee of Rs. 1000 will be applicable before submission of PAN-AADHAAR linkage request“

Link PAN and Aadhaar – Basic Information

- Start Linking Process Early – Start the linking process 10 days before 30-June-2023, as linking can be initiated ONLY after 5 working days of payment of the linking fee

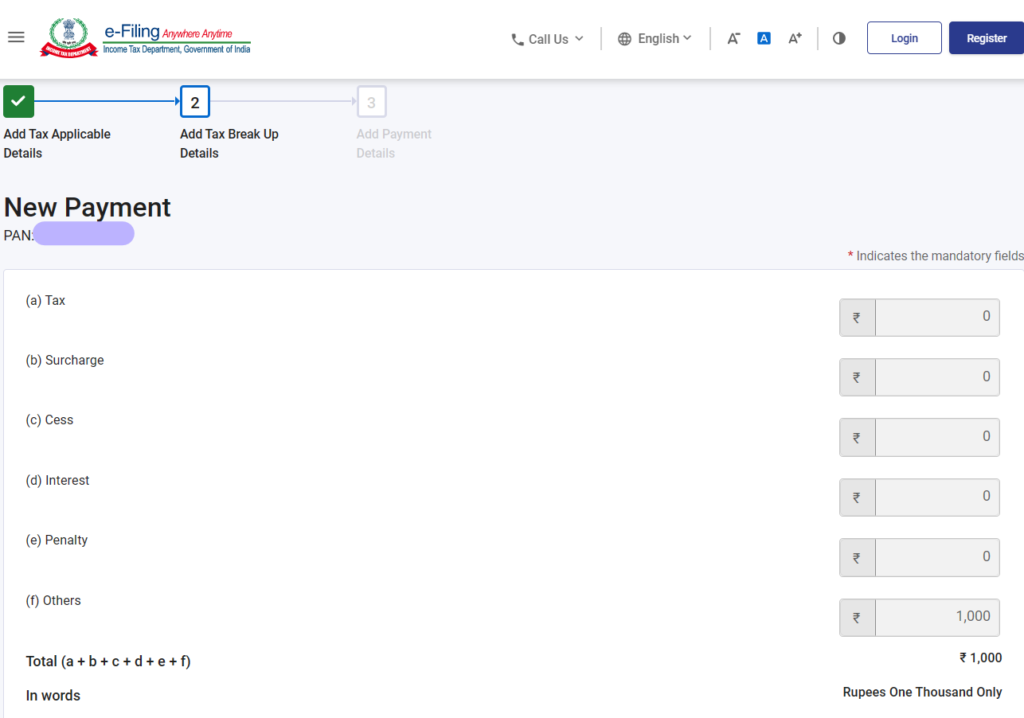

- Linking Fee – Rs 1,000. If the amount is LESS than or GREATER than Rs 1,000, the amount shall be considered as INVALID for purpose of Aadhaar-PAN linkage

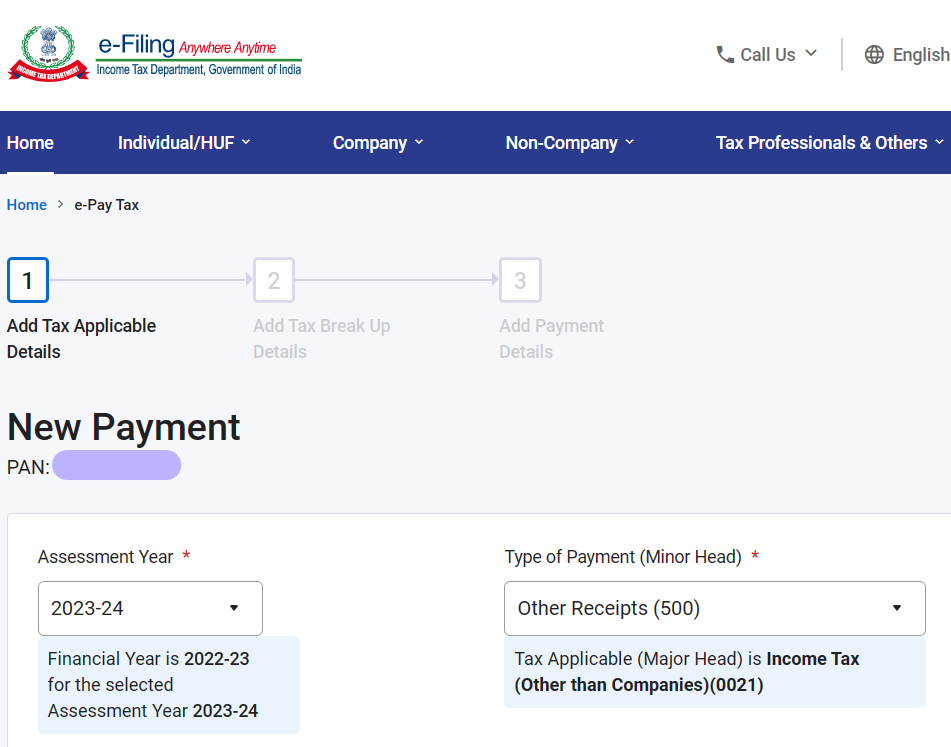

- Assessment Year (AY) – The challan for fee payment should be with the AY 2023-24 ONLY

- Category – Fee challan should be with major head (0021), minor head (500)

- Only SINGLE challan of fee amount Rs 1000 with Minor head code 500 will be considered as valid fee for Aadhaar-PAN linkage. Multiple challans with major head (0021), minor head (500) and AY 2023-24 aggregating to Rs 1000 will NOT be considered as valid fee payment. There should NOT be any aggregation of challans with PAN-Minor head 500 to arrive at amount of Rs 1000

- Prerequisites

- Valid PAN

- Aadhaar number

- Valid mobile number

Online Steps to Link PAN and Aadhaar

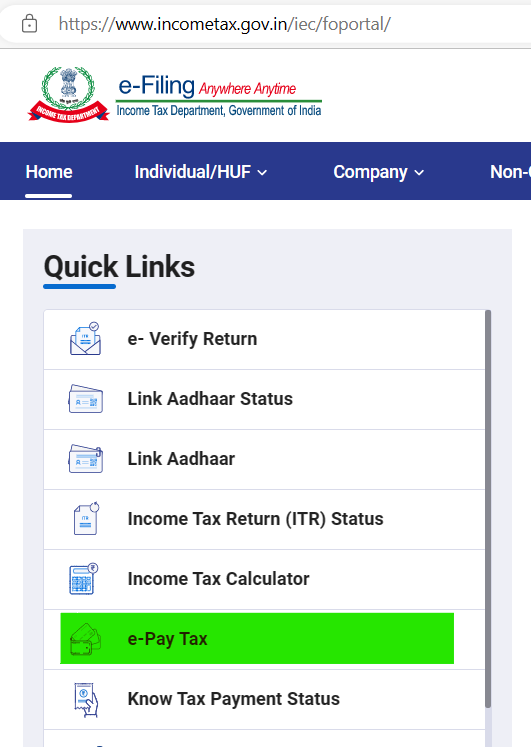

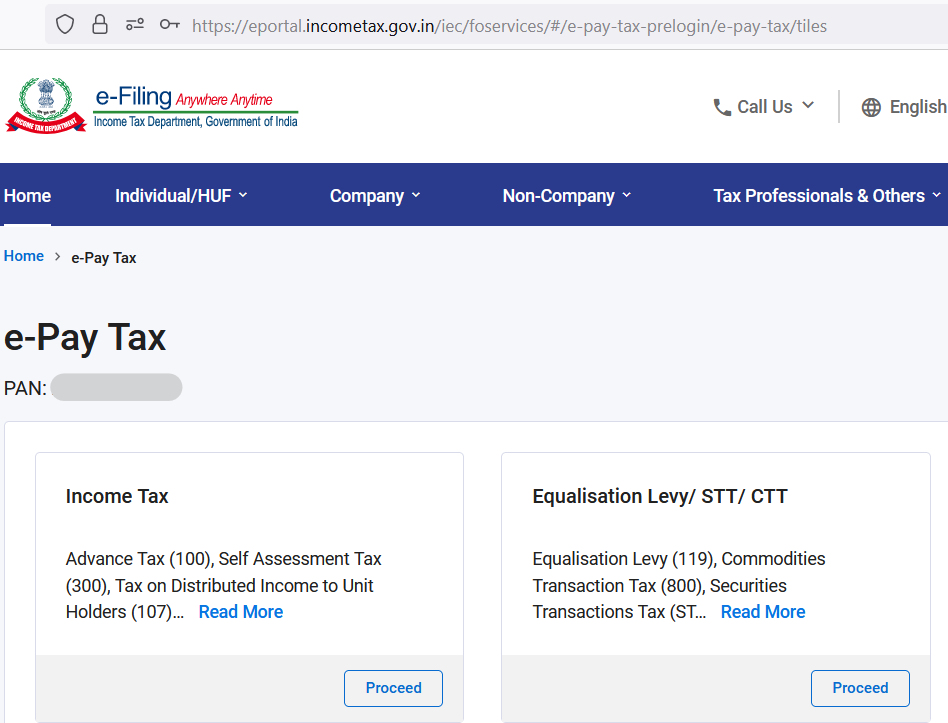

- STEP 1 – Visit income tax e-filing portal – https://www.incometax.gov.in/iec/foportal/ and click on menu “e-Pay Tax“

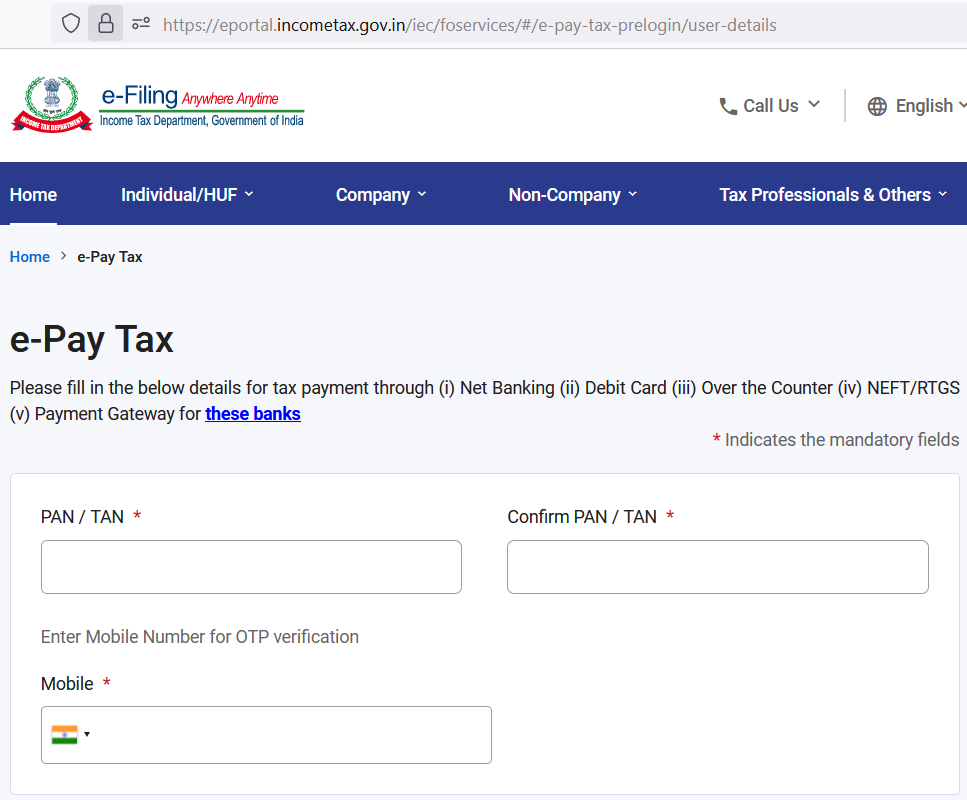

- STEP 2 – Enter PAN and Mobile Number

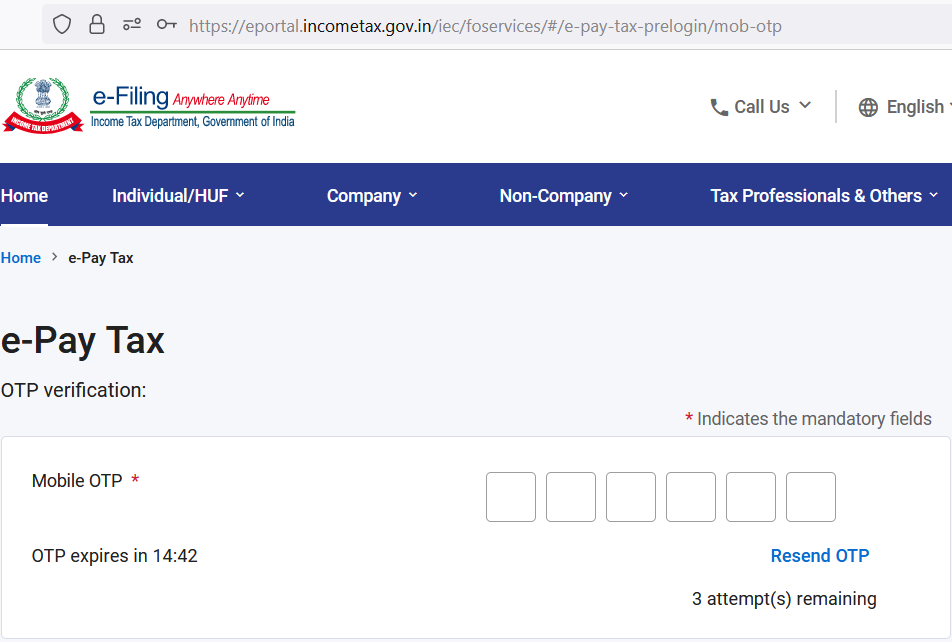

- STEP 3 – Enter OTP received

- STEP 4 – Click on “Income Tax” Proceed

- STEP 5 – Select “Assessment Year” as “2023-24” and “Type of Payment (Minor Head)” as “Other Receipts (500)“

- STEP 6 – Review data and continue to pay Rs 1,000, the PAN and Aadhaar, linking fee

- STEP 7 – Select Bank and follow rest of screens to make payment. Save the payment acknowledgement for future reference

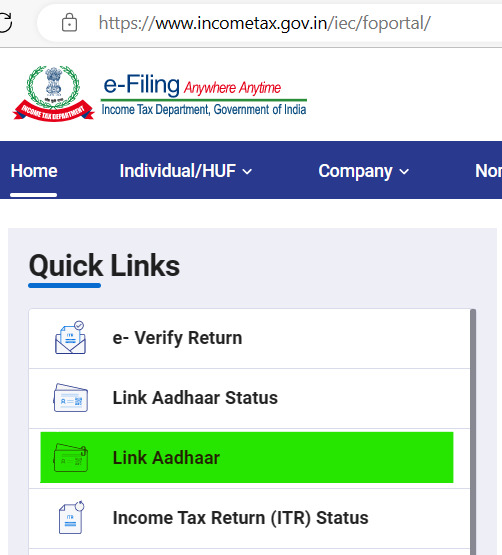

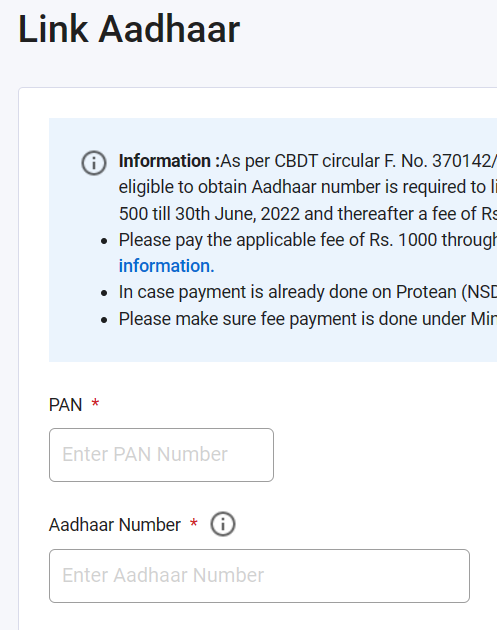

- STEP 8 – 5 WORKING days after making fee payment, visit e-filing portal – https://www.incometax.gov.in/iec/foportal/ and click on “Link Aadhaar“

- STEP 9 – Enter PAN, Aadhaar and click “Validate“

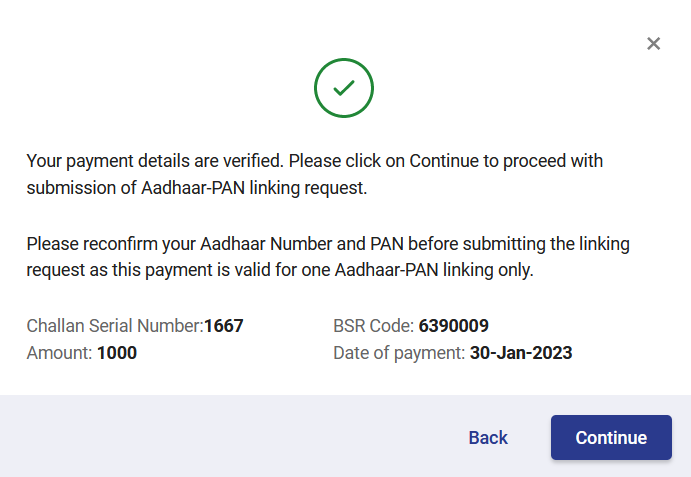

- STEP 10 – PAN-Aadhaar fee payment information is displayed, click “Continue“

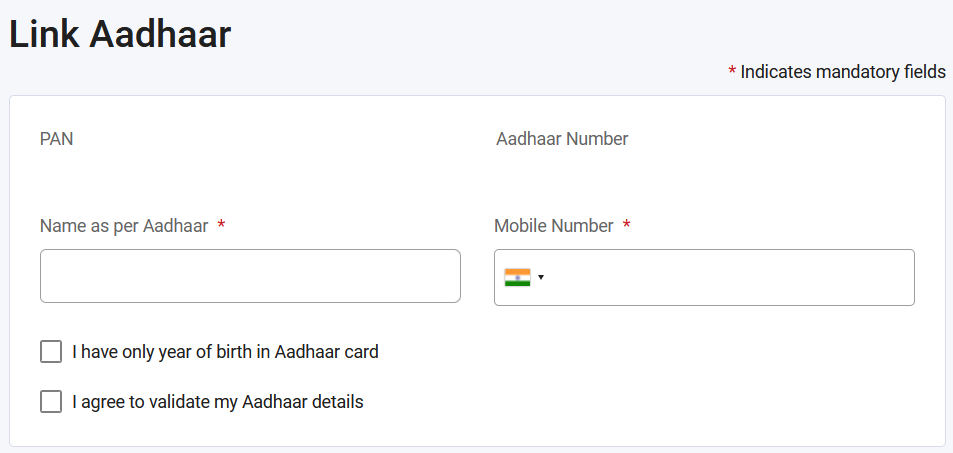

- STEP 11 – Enter Name, Mobile, Select “I Agree” and continue. OTP is sent to mobile entered

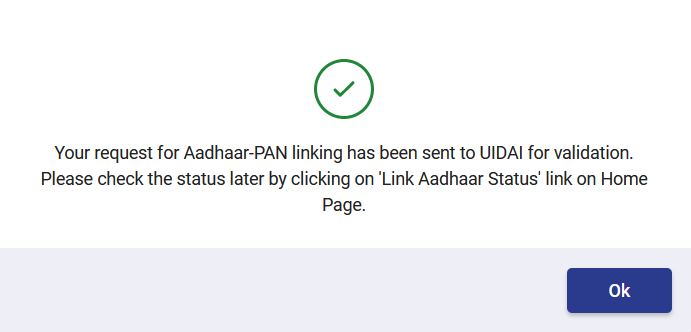

- STEP 12 – Enter OTP and continue. Confirmation message is displayed