Value Investing is Working and Value Investing will Continue to Work

In general investment portfolio is designed for long haul. At times, a portion, 10 to 20%, of the portfolio can be tactically invested as and when opportunities come along. Value investing have been outperforming Growth Investing since Covid, 2020, as highlighted by the chart between indices of “Nifty50 Value 20” and “Nifty Growth Sectors 15”.

Going forward too Value Investing is expected to continue to outperform Growth Investing. Value Investing is investing in stocks priced lower based on some fundamental financial parameters. In simple laymen terms investing in companies which are matured and which are boring, for example TCS, NTPC, L&T, Hero MotoCorp, Hindalco Industries, Hindustan Unilever Ltd, etc. Growth Investing is focused on stocks that are young or small companies or companies whose earnings are expected to increase at an above-average rate compared to their industry sector or the overall market, for example, ITC, Mahindra & Mahindra, Sun Pharma, Tata Consumer Products, etc.

In an low interest rate and low inflation environment Growth Investing does well, as companies can borrow money at lower interest rate to invest into business to generate higher growth rate. In an high interest rate and high inflation environment Growth Investing does NOT do well, as companies can NOT borrow money at low interest rate to invest into business so company growth rate slows down. Value Investing does well in high interest rate and high inflation environment, as matured companies can increase prices of their established products, thereby increasing their business.

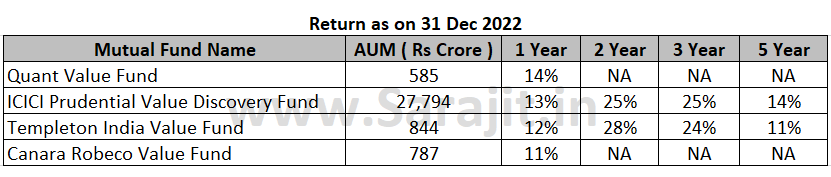

Right now interest rate and inflation both are high, and are expected to remain high for some more time. So Growth Investing is expected not to do well relatively compared to Value Investing. One can consider to allocate a portion of portfolio to Value Investing to generate better returns. Some of the mutual funds based on Value Investing are –

Nifty50 Value 20 ( NV 20 ) – Tracks performance of 20 large sized value stocks which are part of Nifty 50 universe. Selection parameter for securities are Return on Capital Employed, Price Earnings Ratio, Price to Book Value and Dividend Yield%

Nifty Growth Sectors 15 ( NI15 ) – Index provides exposure to the liquid stocks from sectors which are aggressively tracked by market and on which stock derivatives are available. Selection parameter for securities are Price Earnings Ratio, Price to Book Value and EPS growth. Index comprises of 15 stocks.

DISCLAIMER –

Equity/Stock/Share/Mutual Fund investment are subject to market risks. The article/post is NOT an investment advice. The article/post is an opinion. Please do your own research and/OR consult your investment advisor before making your investment. Past performance is not indicative of future returns. Please consider your specific investment requirements before choosing your investments or designing a portfolio that suits your investment needs. The article/post or the author cannot be held responsible for any losses