Actively Managed Mutual Funds – To Beat Equity Index Return

Indian Equity Market benchmark “Nifty 50 Index” generated 4.5% in calender year 2022, Jan-22 to Dec-22. Some diversified mutual funds have generated 20% return in the same period. Surprising, isn’t! For this one needs to understand and accept the fact that “More than the sectors, India is about the cherry-picking of stocks. Selective stock picking is going to be rewarding even in 2023. Anybody can go wrong in predicting the index but the trajectory of wealth creation or returns is going to be definitely very positive in 2023 and the coming years“.

What worked last year, may not work this year and also what did not work last year, may work this work. Funds needs to be in a constant look out for opportunities to generate better return. The current economic and equity market environment is a stock pickers market. To generate additional return over and above the Equity Index, active fund management is necessary. Mutual funds which have consistently outperformed equity index over long periods, 3 to 5 years, are an option to invest in active fund managed investment products.

70% of staggering return – some of the sectoral funds have generated this mind boggling return in 2022, what about that!

Get in touch if you want to know about them!

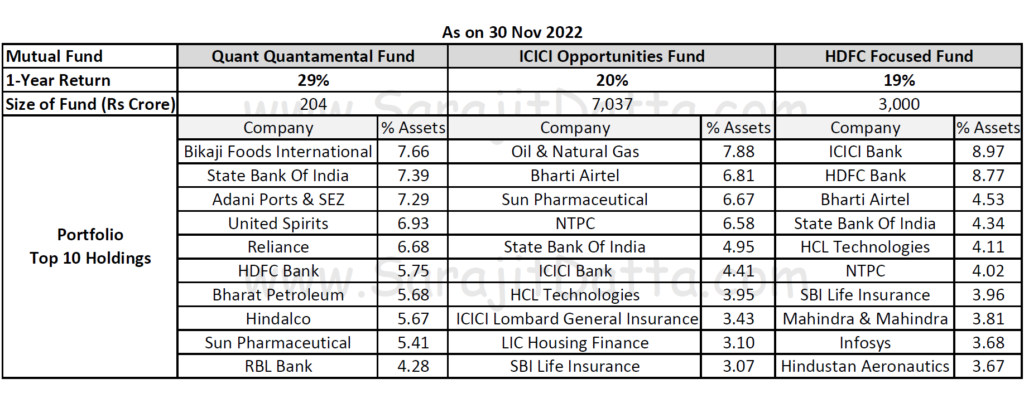

Without much delay sharing 3 diversified mutual funds which generated significantly higher return than equity index in year 2022. Interestingly these funds have consistently generated high returns and have beaten the equity index return even over last 3 to 5 years period.

Contact to know about about such mutual funds

DISCLAIMER –

Equity/Stock/Share/Mutual Fund investment are subject to market risks. The article/post is NOT an investment advice. The article/post is an opinion. Please do your own research and/OR consult your investment advisor before making your investment. Past performance is not indicative of future returns. Please consider your specific investment requirements before choosing your investments or designing a portfolio that suits your investment needs. The article/post or the author cannot be held responsible for any losses