Correlation Between “Dollar Index” and Gold/Silver Prices

Must be wondering why price of Gold and Silver have gone crazy in recent months. Price charts of Dollar Index, Gold and Silver gives the obvious secret.

One important terminology or concept, before moving further – “Dollar Index”, symbol DXY. Dollar Index is NOT price of US Dollar currency. Dollar Index (DXY) tracks price of US Dollar against six foreign currencies, aiming to give an indication of value of US Dollar in global markets. Dollar Index rises when US Dollar gains RELATIVE strength against other currencies and Dollar Index falls when Dollar weakens RELATIVELY against other currencies. Refer to note at end of this article.

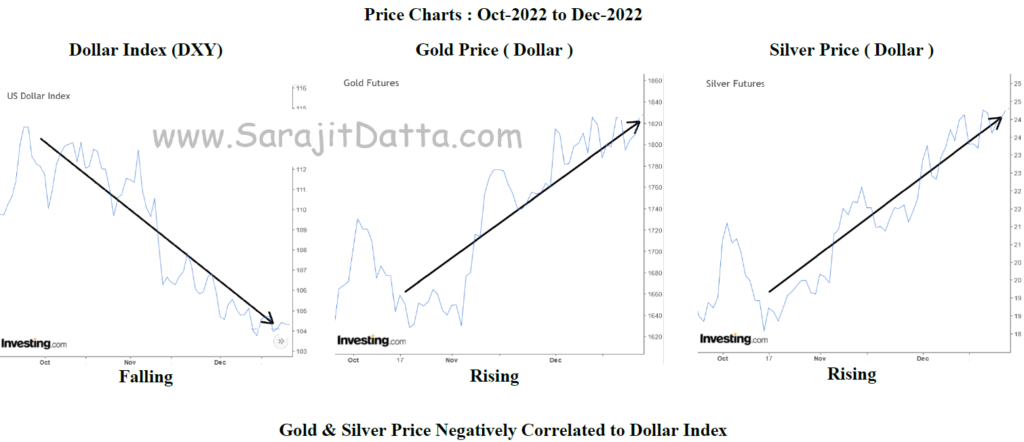

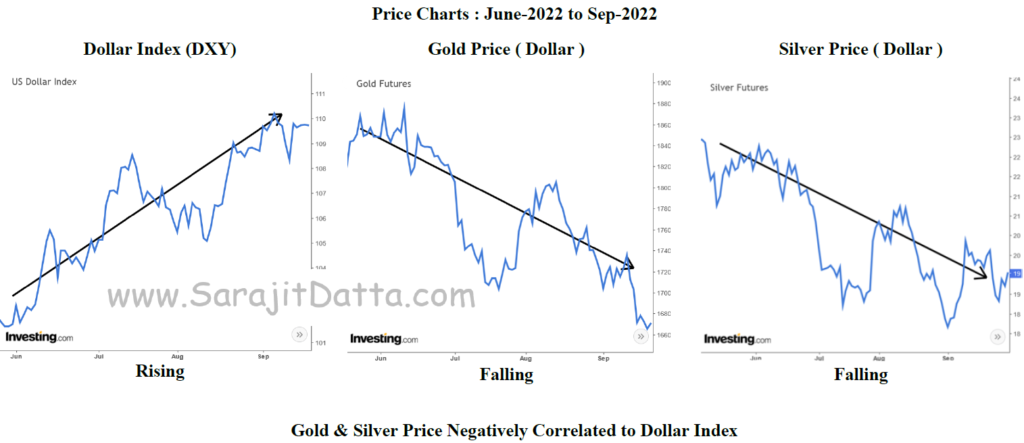

Very obvious from above price charts that Dollar Index and price of Gold & Silver are inversely (negatively) correlated. Meaning when Dollar Index falls, Gold & Silver prices increases. And vice versa, when Dollar Index increases, Gold & Silver prices falls.

In recent months (Oct-2022 to Dec-2022) Dollar Index have been falling, so Gold & Silver prices have been increasing. See how easy it is to predict price trends of gold & silver based on Dollar Index trends. BUT catch is how to predict trends of Dollar Index ? Any Ideas OR Thoughts ? Food for future article.

Some more price charts to support Dollar Index and Gold & Silver price trends

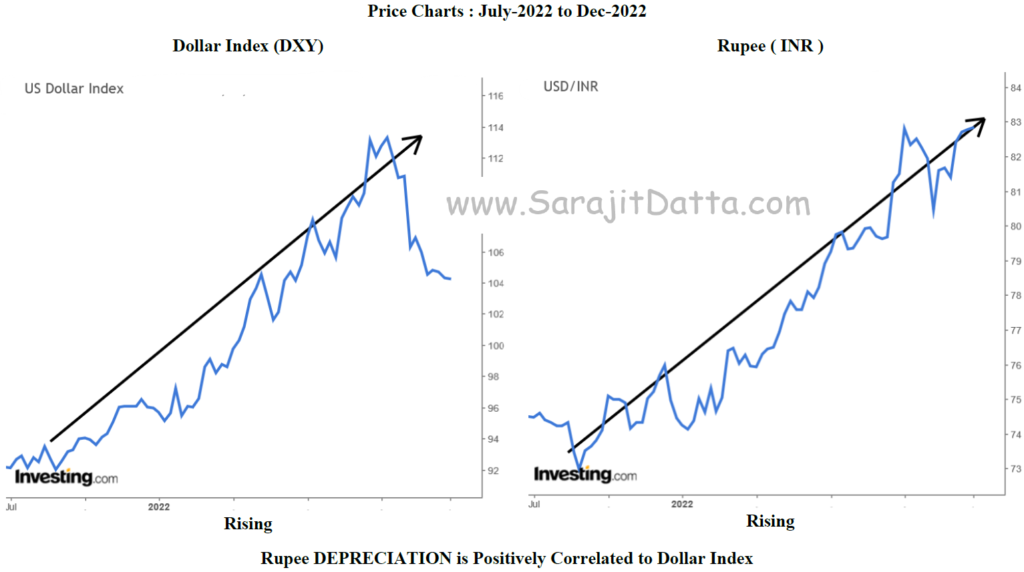

Our own currency, Rupee ( INR ), Depreciation OR Appreciation, too dances to trends of Dollar Index –

Note on Dollar Index

Dollar Index is a weighted geometric mean of US Dollar’s value relative to following select currencies:

- Euro (EUR), 57.6%

- Japanese yen (JPY), 13.6%

- Pound sterling (GBP), 11.9%

- Canadian dollar (CAD), 9.1%

- Swedish krona (SEK), 4.2%

- Swiss franc (CHF), 3.6%