Indian Equity Market – Structural Change to Support and Growth

Emergence of Giant Funds and AUM ( size ) growth on Auto-Pilot is one of SIGNIFICANT STRUCTURAL CHANGE, which will continue to support the Out-Performance and the Over-Valuation of Indian Equity Market. Now it’s a call you need to make whether OR not you want to participate in this structural growth of Indian Equity Market and benefit from it over the long run!

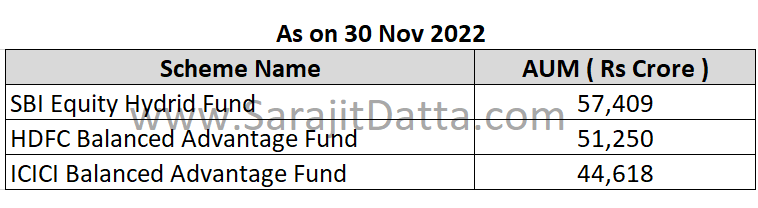

AUMs ( Asset Under Management ), jargon for size, of 3 largest Mutual Fund Schemes are –

Above AUMs are large and impressive amounts. These scheme data and AUM ( size) is public knowledge.

There are large number mutual fund schemes and ETFs ( Exchange Traded Fund ) not available in public knowledge whose AUMs are much much larger than above mentioned AUMs. Let’s call these “schemes and ETFs” as “GIANT Funds”. The beauty of these GIANT Funds is, their AUMs have been growing without anybody’s knowledge, without any sales, without any marketing. Basically their AUMs are growing automatically on Auto-Pilot. Must be kidding, how is this possible!

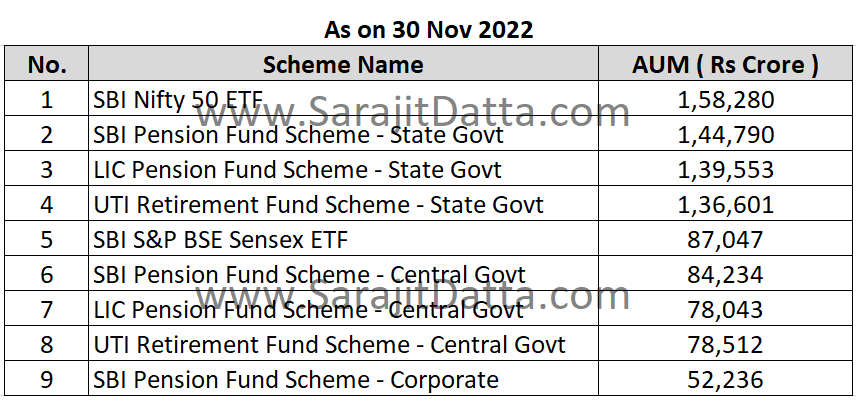

OK, let’s marble at some aspects, one at a time, of these Giant Funds. First, consider their AUM size – hold on your breath, do not be surprised on reading further. The undisputed king is “SBI Nifty 50 ETF”, AUM is Rs 1,58,280 Crore. Yes, KOOL Rs 1,58,280 Crore!

Complete list of Giant Funds is –

Surely, must be impressed by the shear size of above Giant funds!

Now let’s focus on GROWTH in assets or size or AUMs of these Giant Funds.

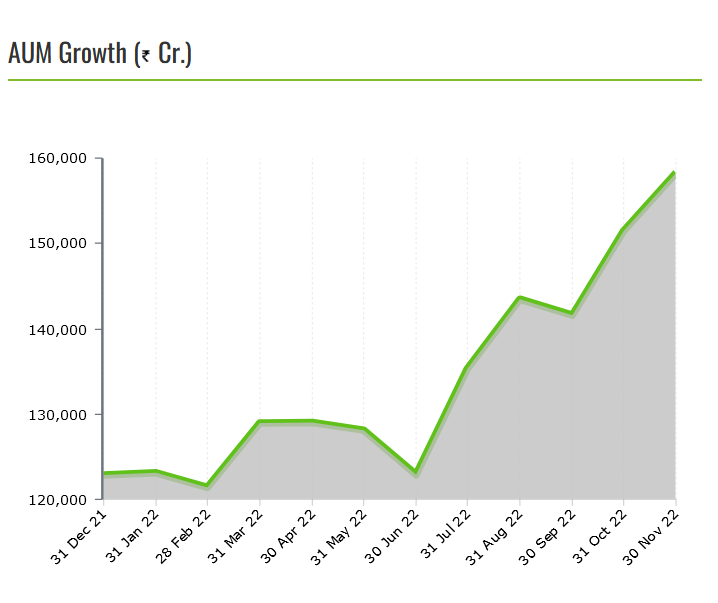

AUM Growth chart of “SBI Nifty 50 ETF” is –

The impressive and staggering growth in AUM is happening inspite of Nifty Index growing by only 4.5% in last year. And AUM is growing without anybody’s awareness, without any sales, without any marketing! Must be wondering, how are these AUMs growing, are they on steroids?

Get in touch to know “How Giant Funds are Growing on Auto-Pilot

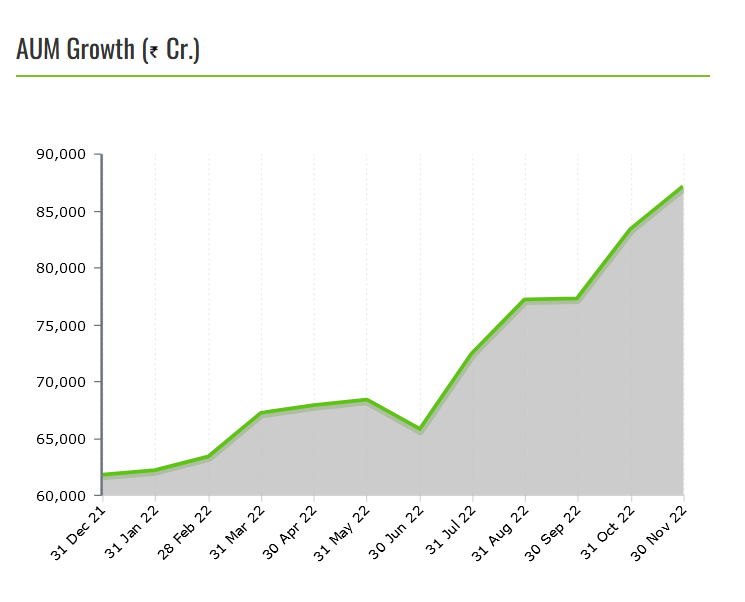

Just to emphasize the growth aspect, AUM Growth chart of “SBI S&P BSE Sensex ETF” is –

Emergence of Giant Funds and AUM ( size ) growth on Auto-Pilot is one of SIGNIFICANT STRUCTURAL CHANGE, which will continue to support the Out-Performance and the Over-Valuation of Indian Equity Market. Now it’s a call you need to make whether OR not you want to participate in this structural growth of Indian Equity Market and benefit from it over the long run!

References – economictimes.indiatimes.com, infinitywealthonline.in, sbimf.com

DISCLAIMER –

Equity/Stock/Share/Mutual Fund investment are subject to market risks. The article/post is NOT an investment advice. The article/post is an opinion. Please do your own research and/OR consult your investment advisor before making your investment. Past performance is not indicative of future returns. Please consider your specific investment requirements before choosing your investments or designing a portfolio that suits your investment needs. The article/post or the author cannot be held responsible for any losses