Investment in Infrastructure, Growth, Momentum, FOMO and Greed

New Businesses of Adani

- Setup a $4 billion petrochemical complex in Gujarat

- Adani runs seven Indian airports, and is currently building a new terminal and runway for Mumbai’s second facility. Overall, 20% of nation’s aviation traffic goes through Adani. Growth in air traffic means growth for Adani

- Launch “Super App” in next three to six months to connect Adani airport passengers with other Adani Group services. The mobile app will connect passengers at Adani’s network of airports with other services offered by Adani group

- Investing in taxi fleets in cities where Adani has airports

- Adani is into airports, ports, power, city-gas distribution, edible oils, mining, logistics and infrastructure, all are growth areas considering the fact that India will continue to growth and India’s GDP is growing

General Rationale for investing into Adani Stocks

- Individual investors are always last investors into multibagger investments. Better be late investor NOW into Adani stocks, rather than LAST investor later on

- At times like in cricket, attack is a form of defense rather best defense. Be an aggressive investor with some portion, like 5% to 10%, of investment portfolio invested into Adani stocks

- Have an entry and exit investment strategy for Adani stocks

- Book returns from Adani stocks, and re-invest booked profit into matured / dividend yielding / steady / etc stocks

- Every stock market listed business owners in the world have lost wealth in calendar 2022, Adani’s stock market valuation increased by $40 billion. Alongside Adani, try to make some money

Macro level rationale for investing into Adani stocks

- Adani businesses are in infrastructure sectors of Airports, Power, Port, Coal, Gas, Energy, Transmission, Oil, etc. India needs infrastructure at a huge scale to become a developed country and to support India’s ever growing population. Adani businesses are in sweet spot of need & growth of infrastructure sectors in India

- Government’s focus on “Infrastructure Development”, “Make in India”, “Self Reliance” and “lower dependency on imports” bodes well for Adani businesses to continue to growth in future

- Infrastructure and Growth sectors are an excellent combination for investments in India, a developing country whose ambitious Prime Minister has a desire to make India a developed country in a hurry

- Momentum is always a help, Adani stocks have done well so they should continue to do well

- FOMO ( Fear of Missing Out ) and Greed of investors are additional tailwinds for investing in Adani stocks. FOMO and Greed is also “next fool in line” investment approach!

Investment and Exit –

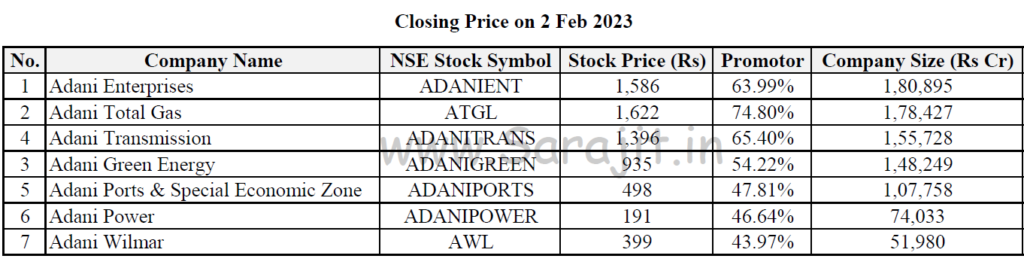

- Investment Strategy – Wish there is an ETF OR Mutual Fund investing ONLY in 7 Adani businesses listed in Indian Stock Market! Instead use “Daily SEP (Systematic Equity Plan)” investment approach to take advantage of market volatility and to average out investment price. For example, in “Daily SEP (Systematic Equity Plan)”, buy 1 share per day for next 20 or more days, depending on investment amount

- Exit Strategy – Keep target return expectation like 25% or 50%. Book profits on a regular basis. Keep the principal invested

DISCLAIMER –

Equity/Stock/Share/Mutual Fund investment are subject to market risks. The article/post is NOT an investment advice. The article/post is an opinion. Please do your own research and/OR consult your investment advisor before making your investment. Past performance is not indicative of future returns. Please consider your specific investment requirements before choosing your investments or designing a portfolio that suits your investment needs. The article/post or the author cannot be held responsible for any losses