Infrastructure and Consumption Growth

Positive Factors for Growth

- Pent-up, Aspirational & Premiumisation Demand, Rising Economic Activities, Improving Sentiments, Favourable Interest Rate

- Low base of current year is a tailwind for growth in coming year. Monthly dispatches of overall automobile sector are expected to grow year-on-year

- Robust demand, easing supply constraints, and dropping commodity prices are likely to provide relief to auto OEMs (Original Equipment Manufacturers) and ancillary companies going forward

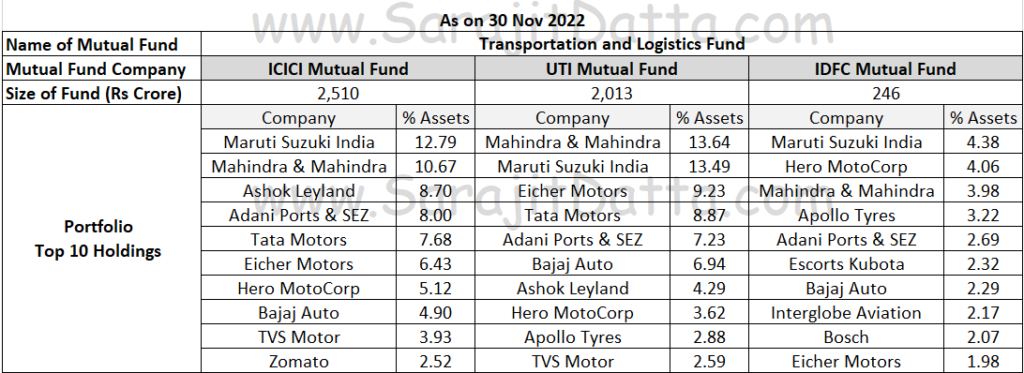

Investment – Fortunately, multiple Mutual Fund schemes are available for “Automobiles and Transportation” sector to choose from as listed below –

CONTACT FOR INVESTING IN TRANSPORTATION AND LOGISTICS FUNDS

Automobile Segments View

- CARS – Demand for Passenger Vehicle (PV) segment, both for 2W (two-wheelers) and four-wheelers (4W), is expected to remain strong, led by new launches and increasing traction for EVs. Demand in urban regions continues to remain buoyant. Strong recovery expected in segment in FY2023, driven by pent-up demand, increasing penetration of EVs, and exciting new launches. Gradual easing of chip shortage augurs well for PV sales. Channel checks of dealers suggest a strong order book in PV segment. Retail sales are improving aided by opening of dealerships. Inquiries and customer footfalls have improved significantly over past few months. Waiting period continues to remain high for newly launched products. Interactions with dealers suggest healthy demand for passenger vehicle (PV) and two-wheeler segments, led by new and refreshed launches, higher discounts and attractive financing schemes. Customer behaviour continues to support Aspirational & Premiumisation trend, with increasing traction of top variants in PVs and 2Ws, while EVs and CNG variants responding positive to launches. Pending orders for PVs on a rise: Easing semiconductor chip shortage situation is boosting production of PVs and premium 2Ws. EV and CNG models continue to gain traction

- TWO-WHEELERS – Rural demand to drive two-wheeler retail sales: Driven by positive rural sentiments, new launches, and attractive sales schemes. 2W volumes is expected to recover, especially in entry and executive motorcycle segments, led by returning of entry-level customers. Premium segment bikes are also expected to do well

- TRACTORS and FARM EQUIPMENTS – Rural demand is expected to drive sales of tractors and farm equipment, benefiting companies having a strong rural and semi-urban presence

- COMMERCIAL VEHICLE (CV) – CV demand remains buoyant supporting recovery in CV segment to continue over next few years, driven by improved economic activities, an affordable interest rate regime, better financing availability, improving sentiments of fleet owners at a lower cost of ownership under BS-VI vehicles and a low base. Commercial vehicles (CVs) and three-wheelers expected to grow year-on-year

- MEDIUM & HEAVY COMMERCIAL VEHICLE (M&HCV) – Sequential improvement expected in M&HCV sales to continue, driven by an expected rise in e-commerce, agriculture, infrastructure, and mining activities

- BUSES and 3Ws – Buses and 3Ws are also expected to improve gradually, as corporate offices and educational institutions open

DISCLAIMER –

Equity/Stock/Share investment are subject to market risks. The article/post is NOT an investment advice. The article/post is an opinion. Please do your own research and/OR consult your investment advisor before making your investment. Past performance is not indicative of future returns. Please consider your specific investment requirements before choosing your investments or designing a portfolio that suits your investment needs. The article/post or the author cannot be held responsible for any losses